Corporate Formation Lawyer Sacramento CA

Do you need a Sacramento Corporate Formation Attorney?

If you’re ready to start a new company or want to expand upon an existing enterprise, you should have an adept corporate formation lawyer Sacramento CA trusts on your side. By choosing a knowledgeable lawyer, you can feel confident that your business has been carefully examined so that it is protected by the most appropriate legal structure.

How a Corporate Formation Lawyer in Sacramento CA Can Help You

The Law Offices of Yee Law Group Inc., PC are prepared to address your business needs and expectations. As a leading Sacramento CA corporate formation lawyer, we understand that the foremost foundation of a successful business is the initial choice of legal entity. This precise selection can not only set a business up for long term success, but also protect individuals against collateral damage should any difficulties or challenges arise. Our corporate formation lawyers may help create any of the following:

- Sole proprietorships

- C corporations

- S corporations

- Partnerships

- Limited partnerships

- Family limited partnerships

- Professional corporations

- Limited liability companies

- Limited liability partnerships

- Joint ventures

- Merger and acquisitions

- Business succession

Once we’ve assisted you in choosing the most suitable, tax-conscious entity option for your new or restructured business, we begin the formation process. This may include all aspects of the incorporation such as:

- Articles of incorporation

- Structuring of bylaws

- Operating agreements

- Employment agreements and policies

- Shareholder agreements

Working with the top Corporate Formation Lawyers Sacramento CA can offer

A corporate formation lawyer Sacramento CA residents trust may assist in the entire legal setup of your enterprise. Experienced lawyers should be able to advise businesses of every type and size. Whether you’re wishing to found a start-up, merge your business with another business, or re-structure your current entity, a corporate formation lawyer Sacramento CA relies on can work with you. In addition to the initial corporate formation, a lawyer may also routinely help you throughout the course of your business operation. For instance, he or she may offer civil litigation, which aims to effectively resolve any business disputes, should they arise.

What questions should I ask a corporate formation lawyer before starting a business in Sacramento, CA?

In the early stages of creating your new company in Sacramento, CA, there are several important questions to ask your corporate formation lawyer. Taking a proactive approach and arming yourself with critical information can save you headaches and ensure that your company is built on a solid foundation. Our corporate formation lawyer assists Sacramento, CA professionals in starting their businesses with legal protections in place. In addition, we can help you identify and reduce your legal risks. Call Yee Law Group to learn more about the legal services provided by our corporate formation lawyer that can help your company grow and thrive.

Prior to meeting with our corporate formation lawyer in Sacramento, CA, you may benefit from developing a list of questions and concerns that you may have about the formation of your new company. The questions and concerns raised by clients varies, but here are several that are common among those business owners who will establish their company in Sacramento, CA:

- What type of business structure should I choose for my new company? There are several types, and though some are more common than others, the insight you gain from an experienced corporate formation lawyer in Sacramento, CA such as one from Yee Law Group, can be invaluable. They can explain in detail why one of the following business structures may be best for you:

- Sole proprietorship. This type is for companies that have one owner. This type of structure results in more personal liability for the owner.

- General partnership. This type is for companies that have more than one owner. This type of structure results in more personal liability for the owners.

- Corporation. This type of structure results in less personal liability for the owners.

- Limited liability company. This type of structure results in less personal liability for the owners.

- Limited liability partnership. This type of structure results in less personal liability for the owners.

- Nonprofit corporation. This type of structure results in less personal liability for the owners.

- What should I consider when choosing my new company’s name? Some people are surprised to learn of the numerous considerations that should be addressed prior to choosing their business’s name. This is particularly true of legal concerns in Sacramento, CA, as our corporate formation lawyer knows very well. For example, the State of California has rules mandating the choice restrictions for company names. In addition, our corporate formation lawyer in Sacramento, California can ensure that your name choice does not infringe on an existing business’s registered trademark. If you choose to trademark your new company’s name, we can help you with the process of gaining trademark protection.

- As an employer, are there ways to minimize my litigation risks? Absolutely, our corporate formation lawyer is fully versed in laws that affect businesses in Sacramento, CA on a state as well as the federal level. With the assistance of a corporate formation lawyer in Sacramento, CA, from our firm, Yee Law Group, you can reduce your risks of fines, penalties, and litigation against you and your company from employees as well as from individuals that you chose not to hire. In essence, we can help you and your company remain in compliance with all applicable laws.

Learn more about the legal services provided by our Sacramento, CA corporate formation lawyer from Yee Law Group.

Yee Law Group Inc.,: A Corporate Formation Lawyer Sacramento CA Respects

Our lawyers have years of experience in the complex laws that surround business entities and their respective formation. You can rely on our knowledge and professionalism to ensure you understand the fine details of taxation, liability, and financing. We’ll also assess the pros and cons of the entity choice before beginning the legal process and the filing of documentation. With this meticulous mindset, we’ll help turn your idea into a viable opportunity.

Rest assured, as a leading corporate formation lawyer Sacramento CA offers, we may assist you in making an informed decision about what is best for your individual needs and circumstances. Ultimately, when you work with Yee Law Group Inc., your interests are fully protected. If you want to know more on how a corporate formation Lawyer Sacramento CA trusts may help you meet your goals, please call (916) 599-7297.

What Should I Consider When Choosing a Corporate Structure?

You’re thinking about forming a company, either for-profit or nonprofit in nature. You have a vision: You know what goods and/or services you want to provide, you have researched your target audience and you have a fairly strong sense of how much capital it will take to turn your vision into an operational reality. Now is the time that you should consider consulting with a Sacramento, CA corporate formation lawyer at Yee Law Group Inc.. Before you sign contracts, take steps to protect your intellectual property, scope out premises, or hire staff, you need to formally create your company’s legal foundations. Most notably, you’ll need to choose a corporate structure for your company before you can tackle other legal issues ranging from incorporation to taxation models. If these tasks sound daunting, please don’t panic. Our experienced Sacramento, CA corporate formation lawyer team can help you every step of the way.

Four Primary Structures – Ins and Outs of Each

Generally speaking, there are four major kinds of corporate structures that new business owners can choose from when starting their for-profit or nonprofit companies. These major structures are: sole proprietorship, partnership, limited liability companies, and corporations. There are potential benefits and drawbacks associated with each model. Our Sacramento, CA corporate formation lawyer team can help you to choose the structure that best serves your vision for your company, your company’s business model and the general kind of company you hope to create (and possibly expand over time).

Sole proprietorships are generally run by a solitary owner. These companies are taxed at the personal income tax level and owners are not generally shielded from personal liability for business debts, collections, and judgements. However, many independent contractors find this model appealing. Their companies function effectively as sole proprietorship operations (despite the lack of liability shield) due to the flexible management style and limited governmental reporting and oversight required of this approach. Partnerships function in most of the same ways that sole proprietorships do, except these operations are owned by more than one person.

Limited liability companies offer a liability shield for owners (referred to as members) and the option to be taxed at the personal or corporate level. However, the oversight, reporting and management requirements of this model are stricter than they are for sole proprietorships and partnerships. Finally, corporations have strict management requirements and are beholden to (and owned by) shareholders. However, this model allows for fundraising and expansion opportunities as a publicly traded entity, which is attractive for large businesses.

Legal Guidance Is Available

If you’re interested in starting a for-profit or nonprofit company, please schedule a consultation with a Sacramento, CA corporate formation lawyer at our firm today. Our experienced team can help you to explore all of your options so that you can make an informed choice about the best corporate structure model for your company. We look forward to speaking with you.

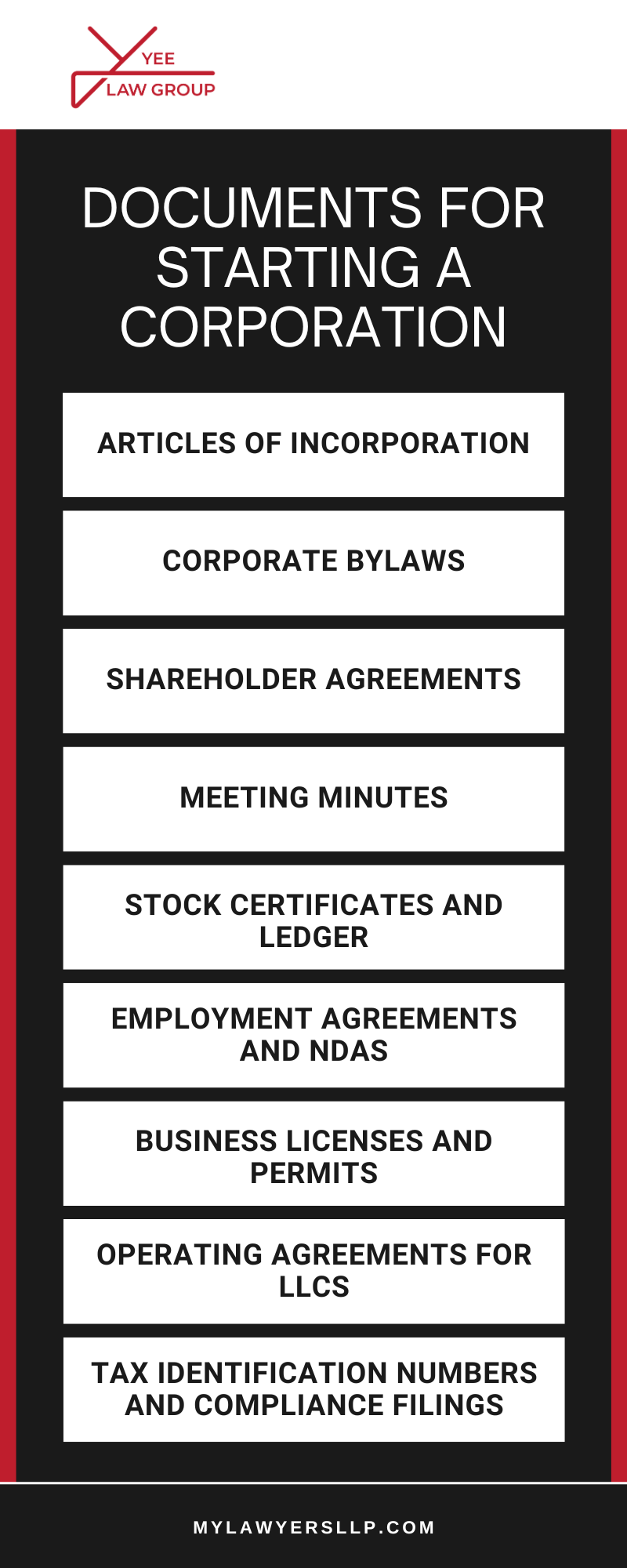

Essential Documents For Starting A Corporation

Careful planning and the preparation of essential legal documents are critical when starting a corporation. Each step is critical to laying a solid foundation for your business. From filing formal paperwork with the state to organizing internal governance, having the right documents in place helps keep the corporation compliant and organized. As a Sacramento, CA corporate formation lawyer, we often guide clients through the documentation needed to start their businesses smoothly.

Articles Of Incorporation

This document is filed with the state to officially create the corporation. It typically includes the corporation’s name, purpose, registered agent, and information about its stock structure. Filing the Articles of Incorporation establishes the corporation as a legal entity and provides the framework for its operation.

Corporate Bylaws

Bylaws are internal rules that govern how the corporation will be managed and it may be helpful when developing these bylaws to have guidance from a business compliance lawyer. They outline the roles and responsibilities of directors and officers, procedures for holding meetings, and rules for decision-making. While bylaws are not filed with the state, they are essential for maintaining operational clarity and avoiding disputes.

Shareholder Agreements

A shareholder agreement defines the rights and responsibilities of the corporation’s shareholders. It can include provisions about stock transfers, voting rights, and procedures for resolving conflicts. For privately held corporations with multiple owners, this document is particularly important.

Meeting Minutes

Our Sacramento corporate formation lawyer shares that corporations are required to maintain accurate records of their meetings, including board and shareholder meetings. These minutes document key decisions and actions taken, providing transparency and protecting the corporation in case of legal disputes or audits.

Stock Certificates And Ledger

Issuing stock certificates and maintaining a stock ledger are vital for tracking ownership in the corporation. The ledger should record details of stock issuance, including dates, shareholder names, and the number of shares issued. While digital alternatives exist, physical certificates remain an important component of corporate governance.

Employment Agreements And NDAs

Our business lawyer shares that for corporations hiring employees, employment agreements set clear expectations about roles, compensation, and confidentiality. Non-disclosure agreements (NDAs) are also vital for protecting sensitive business information from being shared outside the organization.

Business Licenses And Permits

Depending on the industry and location, your corporation may require specific licenses or permits to operate legally. Our business entity formation lawyer can help acquire these documents which are issued at the federal, state, or local levels and must be obtained before commencing business activities.

Operating Agreements For LLCs

If you’re forming a corporation with an LLC structure, an operating agreement is crucial. This document defines the ownership and operational procedures of the LLC and serves as a roadmap for resolving conflicts or clarifying responsibilities among members.

Tax Identification Numbers And Compliance Filings

Securing an Employer Identification Number (EIN) from the IRS is a key step for tax purposes. Additionally, corporations must stay current on annual reports, franchise taxes, and other compliance filings required by the state.

Sacramento Corporate Formation Infographic

The Importance Of Early Legal Guidance

Starting a corporation involves more than just filing paperwork. It requires thoughtful planning and preparation of foundational documents that guide the business’s future. There are many aspects to planning, forming, and operating a business, partnering with professionals ensures that your corporation starts strong, avoiding potential pitfalls.

Incorporating the right documents sets the stage for a corporation’s success. To learn how we can assist with your corporate formation needs, reach out to us today. Our team, including a trusted Sacramento corporate formation lawyer, is ready to help you build a strong legal foundation for your business. With over 40 years of combined legal experience, Yee Law Group Inc., can help to provide straightforward support tailored to your goals. Call today, we offer 24/7 live call answering services.

Frequently Asked Questions About Forming A Corporation

A major step for new business owners is starting a corporation. The right structure affects liability, taxation, and long-term operations. Whether forming a new corporation or restructuring an existing business, understanding the legal process helps avoid complications. Below, we answer some common questions about corporate formation. For those seeking legal guidance, a Sacramento, CA corporate formation lawyer can provide clarity on state and federal requirements.

What Are The Steps To Form A Corporation?

Forming a corporation involves several steps. First, a business must select a unique name that complies with state regulations. Next, the business files Articles of Incorporation with the state, which outline the company’s structure, purpose, and registered agent information. After approval, corporate bylaws must be created to establish internal management rules. The corporation must also appoint a board of directors, issue stock to initial shareholders, and obtain any required business licenses. Finally, applying for an Employer Identification Number (EIN) with the IRS and registering for state tax obligations are necessary to complete the process.

What Are The Benefits Of Incorporating A Business?

As our business formation attorney will share, incorporating a business provides limited liability protection, meaning business owners are generally not personally responsible for company debts or lawsuits. A corporation can also raise capital more easily by issuing stock. Additionally, corporations provide continuity, allowing the business to operate even if ownership changes. Depending on the business structure and state laws, corporations may also benefit from tax advantages. A formalized management structure makes corporations an attractive option for businesses seeking long-term growth.

What Are The Legal Requirements For Corporate Bylaws?

To define how a corporation operates, corporate bylaws are critical. While they are not filed with the state, bylaws serve as an internal framework for decision-making. They typically outline director and officer roles, shareholder rights, voting procedures, and meeting requirements. Bylaws also address stock issuance, conflict resolution, and amendment processes. While state laws do not mandate specific provisions, having well-structured bylaws helps maintain compliance and avoid internal disputes. A Sacramento corporate formation lawyer can assist in drafting bylaws that align with business objectives.

What Is The Difference Between A C Corporation And An S Corporation?

The main difference between a C corporation and an S corporation is how they are taxed and structured. A C corporation pays corporate income tax, and shareholders also pay taxes on dividends, which results in double taxation. However, C corporations have no restrictions on ownership and can issue multiple classes of stock. In contrast, S corporations pass income directly to shareholders to avoid double taxation, but they are limited to 100 shareholders and must meet specific IRS requirements. The choice between these structures depends on a business’s tax strategy and long-term financial goals.

HOw Do I Maintain Corporate Compliance After Incorporation?

Maintaining compliance involves meeting ongoing legal and financial obligations, which a corporate structuring lawyer can assist with. Corporations must hold annual shareholder and director meetings, maintain records, and file annual reports with the state. Businesses must also keep up with tax filings, renew necessary licenses, and follow corporate bylaws. Failure to meet these requirements can result in fines, penalties, or loss of corporate status. Staying compliant protects a corporation’s legal standing and financial health.

Protecting Your Corporation’s Future

The first step towards building a successful business is the formation of a corporation. Our business incorporation attorney can help with ongoing compliance and sound corporate governance in efforts to help maintain stability and long-term success. For businesses needing legal guidance, a Sacramento corporate formation lawyer can provide support with formation, compliance, and corporate management. When you meet with our team, we will strive to first understand; who you are, what you value, where your concerns lie, and what goals you seek to achieve. By doing so, we can develop strategies that are specifically tailored to accomplish your objectives in the most efficient, effective, and economical way possible. Yee Law Group Inc. assists businesses in meeting their legal obligations and protecting their interests. Contact us today to discuss your corporate formation needs, we offer 24/7 live call answering.

Client Review

“I highly recommend the Yee Law Group. They are very professional and knowledgeable and I have always had a good experience working with their attorneys and staff. They have earned my trust and confidence for my future needs as well. Great job guys!”

Kenneth Guy