Trust Attorney Roseville CA

Trust Attorney – Roseville, CA

Trust Attorney – Roseville, CA

If you want to put a plan in place to ensure an organized distribution of your assets in the event of your death, you should have an experienced trust attorney Roseville CA offers to guide you through the process. Yee Law Group Inc. is well-versed in standard trust planning as well as those which could be considered complex or out-of-the-ordinary. Using our knowledge and skill we can develop a plan that meets your objectives in a clear manner. A Roseville trust attorney offers several advantages that are not available through the sole drawing-up of a will. When you’re ready to protect your assets and estates, consider having Yee Law Group Inc. on your side. Contact us now for a free consultation.Table Of Contents:

- An Introduction to Trusts – What They Do and What They Don’t Do

- Take Control of Your Monetary and Physical Assets

- Why You Need a Trust Attorney Roseville CA Respects

- What the Trust Will Accomplish

- Which Assets to Include

- Who Will be the Trustee

- What You Should Consider When Choosing a Trust Attorney

- Benefits of Yee Law Group Inc.

- Trust Attorney Statistics

- QA About Types of Trusts

- Legal Assistance Is Available

- Scheduling a Consultation with Yee Law Group Inc.

What Trusts Do And What They Don’t Do

A living trust—which can pass certain assets to your loved ones during your lifetime and can serve as a will after your death that will allow your loved ones to avoid probate—is primarily used as an alternative for a will. This document will not detail your wishes for medical care at the end of your life, nor will it grant the power of attorney authority to someone you trust so that your affairs can be managed according to your wishes in the event of incapacitation. A living trust can accomplish much, but not everything that someone needs in a basic estate plan. Other kinds of trusts, including charitable trusts, educational trusts and special needs trusts, can accomplish various financial and practical aims while you’re living or after you’re gone. These resources can serve as great tools to pass along assets subject to conditions and can minimize your tax liability.Take Control Of Your Monetary And Physical Assets

Deciding what will happen to your assets, wealth, and possessions when you die or become incapacitated could be a difficult process. However, if you fail to do so, you risk having a court divide your total property as it sees fit after you pass. Rather than leaving these important personal decisions to the law, it’s advisable to get legal assistance. A trust attorney Roseville CA relies on can guide you through all steps of the process. Some services a trust attorney may provide include:- Living Trust Planning and Creation: Also called a revocable trust, a living trust is a legal document which places all of your assets into a trust for your benefit. Upon your death or incapacitation, the assets will be transferred to your designated beneficiaries of your choosing, also known as successor trustees. In general, if you have over $1 million in assets, you should have a trust attorney Roseville CA respects to help you with the planning and execution of this document.

- Asset Protection: Most people are not aware of the importance of asset protection, especially when a large estate is a factor. A trust attorney in Roseville CA may help to protect your wealth and personal assets from a wide spectrum of legal structures including civil litigation, divorce, taxation, and bankruptcy. Learn how Yee Law Group Inc. may protect you and your family by calling us today.

- Probate: If you’re experiencing a feud over a will, a trust attorney Roseville CA depends on may assist in defending your right to any legal distribution and keeping potential aggressors in check. By having an attorney on your side, you may be able to speed up the process and ensure your loved one’s wishes are fulfilled in a timely manner.

- Trust Administration: After the loss of a loved one you may have questions or concerns about a trust, will, or being a beneficiary. Oftentimes, there may be confusing paperwork and a lot of signatures to give. By working alongside a trust attorney Roseville CA residents can count on, a detailed, accurate roadmap may be developed to smoothen the procedure and let you focus on the grieving process.

Why You Need A Reliable Lawyer

Although there are software programs and downloadable forms that allow you to create a trust on your own, they are very basic. Should you choose to take this route you could risk causing future problems for your beneficiaries. One word in the wrong place could allow a court to misinterpret your wishes. It might also leave a legal loophole for arguments between beneficiaries to ensue. The reality is that even if you are sure about creating your own trust, you should at the minimum have a trust attorney in Roseville CA review it to ensure it is legally binding in the very way you wish it to be. If you are considering a Roseville trust attorney, please read over the following to get a better understanding of why you should opt for their professional guidance:- An attorney can help to identify what issues might impact your estate and what needs to be included to address and protect your interests;

- A trust attorney Roseville CA offers can discuss and consider the marital deduction rule;

- A last will and testament can be drafted for the distribution of your assets; and

- A guardian can be appointed to someone who is a minor or incapacitated.

What To Consider Before Creating A Trust

A trust is a great way to plan your estate. With a single document, a trust attorney in Roseville, CA of the Yee Law Group can safeguard your assets and dictate how and to whom they are distributed once you are no longer able to do so yourself. That said, a trust is a complex estate planning tool. It deserves a lot of forethought. These are a few factors you should consider as you prepare for a consultation with your trust attorney.What The Trust Will Accomplish

Ask yourself why exactly do you need a trust. Are you interested in ensuring that your assets don’t have to go through probate? Are you hoping to leave an inheritance for a loved one who may also need to rely on government benefits when you are gone? Do you have a large estate that is better off managed by a trust for tax and complexity reasons? All of the above questions make a difference in how your trust attorney in Roseville, CA drafts and arranges your trust. For instance, if you want to safeguard your assets to ensure that a loved one can still access much-needed government benefits due to a lifelong disability, you will want to invest in a special needs trust. If you want a trust that you can change later in life, but with which you are hoping to avoid probate, you may be interested in consulting the Yee Law Group about a revocable living trust.Which Assets To Include

Once you establish what type of trust you want your trust attorney in Roseville, CA to draw up, you have to decide which assets to include. Do you want your real estate property to be entered into the trust? Perhaps you want a substantial savings account to be included in the trust. Which ever property you decide to include, be sure that you think your decisions through carefully. In most cases, people who are interested in using the services of the Yee Law Group to create a living trust want all of their property included. However, if you have other beneficiaries in mind for some of your minor property, you may be interested in leaving them out of the binding document altogether.Who Your Trustee Will Be

One of the most important decisions you will have to make before your trust attorney in Roseville, CA drafts your legal trust is determining who should be the administrator. A lot of the time, people choose close family members to serve as trustees. In this case, you must be confident that your chosen trustee will perform his fiduciary responsibilities to your chosen beneficiaries.What You Should Consider When Choosing Your Attorney

The first question you should ask your prospective trust attorney in Roseville CA is how long he or she has practiced law. Then, you need to discuss how long the firm, e.g., the Yee Law Group, has specialized in trust law, and what percentage of its work involves trusts. You should find a firm that has been in this field for at least five years. Your attorney should understand the ins and outs of creating wills, powers of attorneys and different types of trusts because these documents work together to ensure that your desires are upheld after your death.Geographical Location

Some areas do not have law firms or attorneys that specialize in estate planning and trusts. First, search for an attorney who is licensed in your state, but don’t be afraid to look outside your local community. Therefore, you may look for a trust attorney in Roseville CA, such as the Yee Law Group. However, if you are outside this community, you may still use these attorneys because they are licensed in California. Geography should not be your only consideration when choosing your trust attorney.Their Reputation

You absolutely want a reputable trust attorney in Roseville CA. Therefore, do some research on your prospective firms. For example, you may search through online reviews, but you should also ask other legal professionals for referrals. In addition, you can discuss your prospects with your coworkers, family and friends if they have worked with any of the firms. Ask for and check the firm’s references. Find out whether your prospects carry malpractice insurance as well. This suggests that these attorneys believe in accountability and care about their clients. In addition, some practices are required by the State of California to carry malpractice insurance. Learn whether your firm selections fall under this requirement.Pursuit Of Education

Find out what law school your prospective attorneys attended. Then, discuss their pursuit of additional education. For example, trust and estate planning laws change, and you need to be sure your attorney remains updated about current laws. You should also discuss any professional organizations the firm or attorney belongs to. This may not suggest reputation, but it will suggest how dedicated these individuals are to their field. Professional organizations also provide extensive education opportunities for their members. Your prospects may also have published books or articles on estate planning and trusts. Search out these publications and consider reading them. They should give you some insight into their authors.Is Having A Trust Necessary?

Planning what happens to your possessions, money, real estate, and assets after you are gone is something that is often put off. Either it’s too confusing, time-consuming, or just thinking about it makes you uncomfortable. Do you need a will? Do you need a trust if you have a will? Do you have to have both? Do you need to hire a Roseville CA trust attorney to create these document? Is it expensive? Everyone should have a will. It clears up any questions about which family members get what possessions. If you are married, in most states, including California, everything you have, such as real estate, investments, money in bank accounts, will all pass to the surviving spouse or whoever is named as a beneficiary. If you purchased a home with your spouse, it is likely titled jointly with right of survivorship, meaning if one of the named persons on the title passes away, ownership automatically falls to the surviving spouse. All this seems pretty straight-forward. Is a trust necessary? Maybe, maybe not.Living Trust Advantages

One advantage to a living trust is that you can select an alternate beneficiary to inherit your assets in the event the beneficiary listed on your accounts passes away ahead of you. You cannot do that for property held in a joint tenancy with right of survivorship or payable upon death bank accounts. As a trust attorney in Roseville CA can explain, living trusts will also permit you to transfer assets without going through the probate process. If your assets all have legal beneficiaries and you do not want to list an alternative beneficiary, you probably would not benefit from a living trust. A living trust is most advantageous for wealthier people with large estates or for someone who believes they will be deceased within the next decade or so. When trying to decide whether or not to have a living trust, take into consideration the following:Your Current Age

The idea of having a living trust to avoid probate is that the probate system has been evolving and changing a lot in the last decade to the extent that it is becoming rarer and rarer to have to even use the probate process to distribute assets. That is because investment accounts, insurance policies, and bank accounts all require you to name a beneficiary or a person to whom the account is payable upon the owner’s death, thus eliminating the need for the assets to pass through probate before being distributed. There are also other reasons why a family would want to avoid probate and a trust attorney can provide you with those details. A living trust is of no benefit to you while you are alive, and with the probate process changing, having a legal will is a sufficient means of distributing your belongings to those you love should you unexpectedly die.The Benefits Of Yee Law Group Inc.

Yee Law Group Inc. is the kind of trust attorney Roseville CA families count on for dependable legal counsel. We have built a strong reputation and continue to work hard to maintain it. Some reasons clients turn to us for advice and services include:- We maintain constant communication;

- We are honest and transparent;

- We offer our services in different languages;

- We value our clients;

- We provide emotional support to anyone who may need it; and

- We can arrange to meet you if you are unable to come to us.

Roseville Trust Statistics

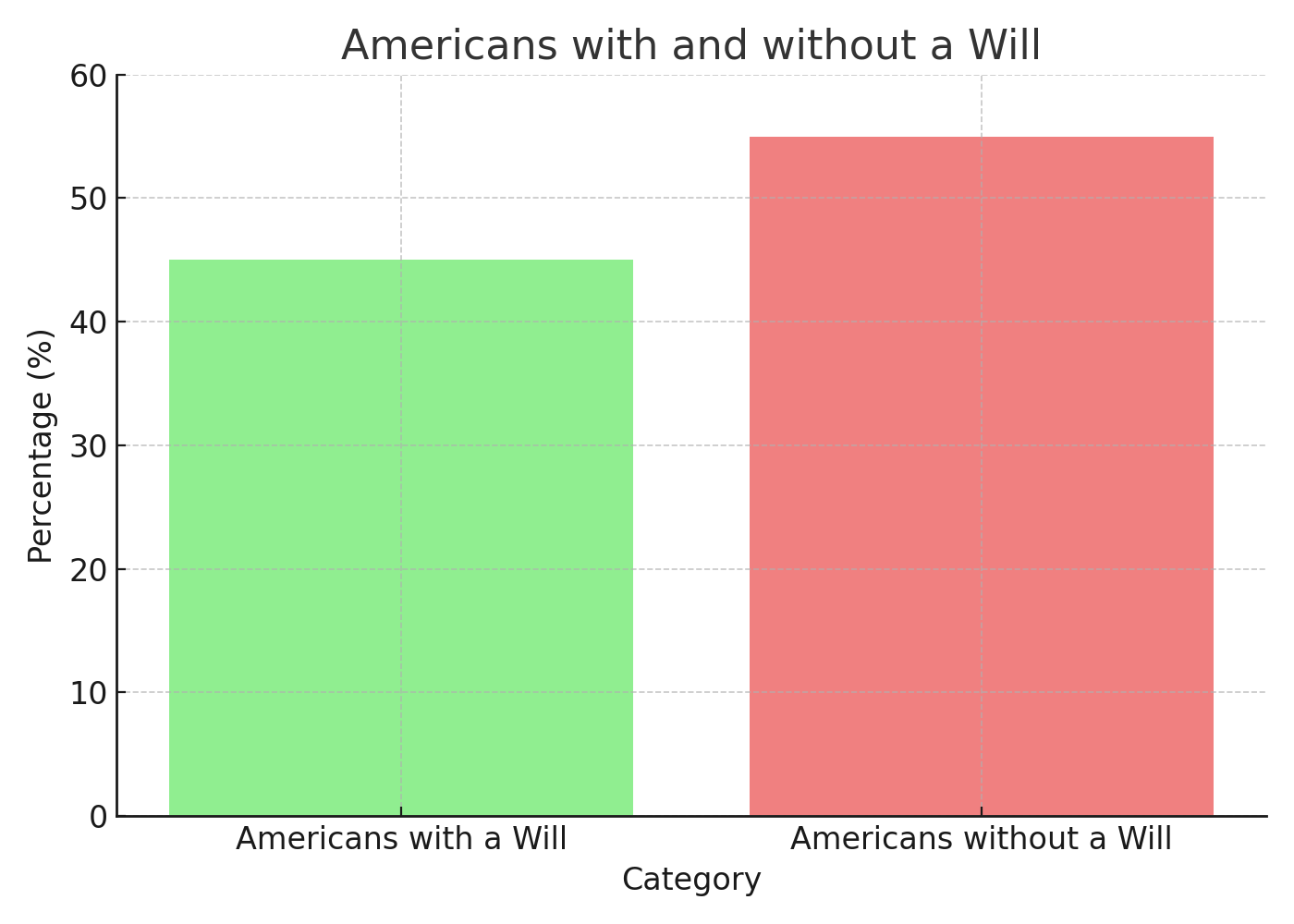

According to a 2021 Gallup poll, less than half of Americans have a will. If you are worth a lot of money and all the wealth cannot be transferred without going through probate, you probably want to create a trust — be it a living or irrevocable trust. If you own a business or have other assets that you do not want to be held up in probate, a trust may be the right path for you to take to protect your wealth. Your Roseville CA trust attorney can evaluate your particular situation and determine which type of trust is best for your family.

Trusts FAQs

What Are the Benefits of Having a Trust?

There are several benefits to using a trust rather than a well. The main positive that comes from establishing a trust is avoiding probate. Probate is a legal process in which a will is reviewed to determine if it is valid or not. The process can be costly and take a lot of time. Other benefits of a trust include privacy, reduced taxes and flexibility. It is more costly to establish a trust than a will, but the benefits may be worth it.What Is a Living Trust?

A living trust is a trust that is set up during a person’s lifetime. They are the trustor, the person who transfers assets into the trust. They may also be the trustee, in charge of managing the trust’s assets and payouts. They may be the beneficiary as well, receiving income from the trust. A trust attorney in Roseville, CA, such as Yee Law Group may be able to help you determine if this is a good option for you.What Is a Testamentary Trust?

A testamentary trust is set up in a person’s will and goes into effect when that person dies. They are still the trustor, whose assets go into the trust, but now someone else must serve as the trustee. A trust attorney in Roseville, CA, can help you set up a testamentary trust in your will.What Is a Revocable Trust?

A revocable trust is one where changes may be made, assets removed or the trust dissolved at any time. You control the trust and what happens within it.What Is an Irrevocable trust?

An irrevocable trust is one where the assets no longer belong to the trustor, and all changes have to be done with the beneficiary’s permission.What Is a Special Needs Trust?

A special needs trust is one that is set up for the benefit of a child or grandchild with special health needs. It protects the beneficiary from losing any government benefits they may receive as a result of their health condition. You need to enlist a trust attorney in Roseville, CA, to help you set up this type of trust.What Is a Tax Bypass Trust?

A tax bypass trust is one that allows one spouse to transfer assets to the other while minimizing the amount of estate tax that would have to be paid on the death of the second spouse. This could save their children tens of thousands of dollars in estate taxes. A trust attorney in Roseville, CA, such as Yee Law Group can help you minimize this tax burden.What Is a Charitable Trust?

A charitable trust is one that is set up for the benefit of a charity of the trustor’s choosing. They are typically set up to minimize the tax burden of the estate.What Is a Totten Trust?

A Totten trust, also known as a poor man’s trust or a pay-on-death trust, includes financial accounts like checking or savings accounts and CDs. It is a safer, faster method to pay out to beneficiaries than joint accounts.What Is the Difference Between a Revocable and Irrevocable Trust?

A revocable trust can be changed at any time. An irrevocable trust, on the other hand, can’t be altered once it has been created. Both trusts come with their own positive and negatives. If you are having trouble deciding between the two, you may want to get advice from a trust attorney in Roseville, CA.Do I Need to Hire an Attorney?

Yes, it is in your best interest to work with an experienced trust attorney. Although there is DIY estate planning software, it is easy to make mistakes if you do not have a legal background. If you do not follow certain procedures, your trust may be considered invalid. An attorney will make sure that your trust states what you want it to state and follow state laws.Do I Have to Be Wealthy to Benefit from a Trust?

Many years ago, trusts were mostly used by wealthy families to control their fortune. This is not the case today. You do not have to be a millionaire anymore to benefit from a trust. People of modest means can benefit from the versatility of trusts.Legal Assistance Is Available

To learn more about trusts and other estate planning tools, schedule a risk-free consultation with the experienced California team at Yee Law Group Inc. today. We look forward to speaking with you.

Roseville Trust Glossary

If you’re looking for a Roseville, CA trust attorney to help build a solid estate plan, understanding key legal terms is a helpful first step. At Yee Law Group Inc., we frequently work with clients who are new to the process and want straightforward, accurate information. Below are some important terms we often discuss with clients when planning for the future of their estate, finances, and family security.Revocable Living Trust

A revocable living trust is a legal document that allows you to place your assets into a trust during your lifetime and retain control over them. The term “revocable” means you can make changes to the trust, including altering beneficiaries or dissolving the trust altogether. When you pass away or become incapacitated, the trust directs how the assets are handled. This helps your family avoid probate, which can delay distribution and increase costs. A Roseville, CA trust attorney can help draft a revocable trust that matches your goals and complies with California law.Successor Trustee

A successor trustee is the individual or entity appointed to manage the trust after the original trustee—typically the person who created the trust—is no longer able to do so. This role is vital in trust administration. The successor trustee has a legal obligation to follow the instructions outlined in the trust and act in the best interests of the beneficiaries. Duties often include paying final bills, managing assets, filing taxes, and distributing property. Choosing the right successor trustee should be done thoughtfully and with legal guidance.Special Needs Trust

A special needs trust is designed to benefit a person with a disability without affecting their eligibility for government programs such as Medicaid or Supplemental Security Income (SSI). Assets placed in this type of trust can be used for certain approved expenses like education, caregiving, housing, or transportation, without counting as income or resources that would disqualify the beneficiary from receiving assistance. A trust attorney in Roseville, CA can explain when this type of trust is appropriate and how it should be structured to comply with state and federal regulations.Trust Administration

Trust administration refers to the process of managing and distributing the assets held within a trust after the trust creator passes away or becomes incapacitated. The person responsible for this process—often the successor trustee—must follow legal requirements and trust terms closely. Tasks can include identifying and gathering trust assets, notifying beneficiaries, handling debts or taxes, and ultimately transferring assets to beneficiaries. Trust administration is an ongoing legal responsibility and may require advice or oversight from an attorney to avoid errors and meet all obligations under California law.Tax Bypass Trust

A tax bypass trust (also called a credit shelter trust) is often used in estate planning by married couples to reduce estate taxes upon the death of the surviving spouse. It allows each spouse to use their federal estate tax exemption individually. When the first spouse passes, a portion of the estate goes into the trust rather than directly to the surviving spouse, reducing the taxable estate later. Although federal estate tax laws have changed in recent years, this strategy can still be effective for certain families. A trust attorney in Roseville, CA can evaluate whether this approach fits your situation. When planning your estate, having a thorough understanding of legal terms like these can help you make informed decisions. At Yee Law Group Inc., we assist clients in Roseville and across California with building practical, personalized estate plans that are legally sound. Contact us today to schedule a free consultation and learn more about how we can help you move forward with confidence.Yee Law Group Inc., Roseville Trust Attorney

919 Reserve Dr, Roseville, CA 95678Scheduling Your Consultation

Regardless of what you may need for your trust planning, creation, or execution, Yee Law Group Inc. could make sure your wishes are carried out to their fullest. For a free consultation with our trust attorney, please call 916-927-9001 today.Client Review

“I recently visited the main office of Yee Law Group in Land Park, Sacramento. The lawyers and their support staff were all so friendly and inviting. The office space is recently remodeled with a clean, bright, modern look. Michael was timely for our meeting and made me feel welcome, valued and safe. I would definitely recommend this office for your estate planning and probate matters. It is so priceless to have a strong, kind legal team with you to navigate trust and estate documents. A+ to Michael and his team!” Amanda Key

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.