Sacramento Trust Lawyer

Sacramento Trust Lawyer

If you have drafted a legally enforceable will, you should pat yourself on the back. You’re already “ahead of the curve” when it comes to the ways in which Americans approach—or fail to approach—estate planning. However, it is important to understand that wills are not “one size fits all” documents, nor do they address all of an individual’s estate planning concerns. As a result, it is important to speak with an experienced Sacramento trust lawyer at Yee Law Group about constructing a comprehensive estate plan. In doing so, you’ll better ensure that your will accomplishes everything it can and that additional estate planning tools—like trusts, power of attorney documents, and living wills—serve their critically important purposes within your broader estate planning approach as well.

Even if you have not yet constructed a will, you can “catch up” in terms of bare bones estate planning by constructing a specific kind of trust. Some trusts function much like a will does—in that they allow an individual to pass on their assets upon the event of their death. The benefit of choosing this kind of trust over constructing a will is that, in doing so, you may allow your loved ones to bypass a lengthy probate process and may minimize your tax liability.

Table Of Contents:

- The Importance of Making a Trust

- Common Myths About Trusts

- Responsibilities of Your Trustee

- How a Trust Can Help a Special Needs Child

- Mistakes to Avoid When Establishing a Trust

- 4 Things You Should Know About Funding a Living Trust

- 4 THINGS YOU SHOULD KNOW ABOUT FUNDING A LIVING TRUST INFOGRAPHIC

- Sacramento Trust Lawyer

- Quality of a Good Trustee

- When do you need a trust lawyer?

- Exploring Different Kinds of Trusts

- Legal Assistance Is Available

- Why Hire Yee Law Group as your Trust Lawyer

The Importance of Making a Trust

When you’re ready to make a trust, contact the Yee Law Group for a Sacramento trust lawyer who is happy to work with you. Our legal team has helped many Sacramento area residents who recognize the importance of making a trust.

A Sacramento trust lawyer can help you create a trust that reflects your needs and wants for what happens to your assets after you pass. Our legal staff understands the peace of mind gained from setting up a legally binding trust. If you have questions about this process or would like to make an appointment with one of our trust lawyers, contact our office today for an appointment. The following guidelines and information may be helpful to you in the meantime.

Avoid Probate with a Trust

Probate is a legal process that involves the court and transfers the ownership of your assets after your passing. The process can be time-consuming and expensive for your heirs. A common way of avoiding probate is to place one’s property into a trust. A Sacramento trust lawyer can review with you all of the advantages and disadvantages of a trust. Here are the common reasons why many people choose to have a trust:

- Irrevocable and revocable trusts can avoid probate.

- Putting one’s property into a trust can prevent it from going through probate.

- Having a trust in place allows your survivors to avoid the expense of going through probate.

Everyone’s situation is different, so talk to a Sacramento trust lawyer from the Yee Law Group to find out if a trust is the right solution for you.

Trusts Offer Privacy

If you would like to protect your privacy and your family’s privacy regarding your estate after your passing, a trust can do this for you. If privacy is important to you, be sure to share this with your trust lawyer in Sacramento. While the probate process is public, trust property remains private. Your designated trustee and the trust’s beneficiaries may be the only ones who can have access to information about your estate.

Control Your Assets After Your Death

When you bequeath your assets to beneficiaries through a will, they may receive those assets immediately after you pass on. By using a trust, the beneficiaries can receive your assets over a period of time. This can be useful if you want your beneficiaries to first reach a certain age or milestones in their life. Your designated trustee can manage and control your assets until they distribute them to the beneficiaries. Speak to a Sacramento trust lawyer to learn more about the various kinds of trusts available to choose from:

- Minor’s trusts

- Spendthrift trusts

- Special needs trusts

A Trust Lawyer Can Help You

For many people, determining what happens to their property after they pass is very important to them. To make sure that your wishes are legally binding, it’s important to have a legal representative file the necessary paperwork. Call us today at the Yee Law Group to speak with a Sacramento trust lawyer.

Discretionary Trusts – What You Need to Know

As you prepare for the future, you may wonder whether creating a trust could improve the lives of your beneficiaries. You might also wonder how best to protect your assets so that your loved ones can benefit from them to the fullest extent possible after you’re gone. Depending on your circumstances, an experienced Sacramento trust lawyer from Yee Law Group may recommend that you consider a discretionary trust as part of your broader estate plan.

What Is a Discretionary Trust?

There are various types of trusts that individuals and couples can create for their family members and other beneficiaries. A discretionary trust is one of those types. A trustee manages the beneficiaries’ assets, dispersing them at the times the settlor previously determined. What’s different between this and a typical trust is a discretionary trust is more protected because it is to be used at the settlor’s discretion, so the beneficiary doesn’t have total access to the assets all at once. You may work with an experienced Sacramento trust lawyer to better ensure that the terms of your discretionary trust make sense for your goals and your beneficiaries. If you have a loved one who tends to be impulsive with money, struggles with addictions, doesn’t have excellent financial management skills, etc. this kind of trust may be an especially great option for you.

How Are They Made?

There are two ways a settler can create a discretionary trust. The first is during the time he or she is alive. He or she will write the Trust Deed, sign it then have the trustee sign it. The assets will then be held in a trust under the trustee’s name.

If the settlor includes a discretionary trust as part of his or her will, assets will be placed in a trust until he or she dies. According to the terms laid out in the will, the trustee will assume responsibility for the trust after the settlor passes away. Most settlers will also include a Letter of Wishes so the trustee knows exactly how he or she wishes the trust to be dealt with. Your Sacramento trust lawyer can help you explore whether it may make more sense for you to create a living or testamentary trust.

Why Should You Use a Discretionary Trust?

If you’re looking ahead to the financial futures of your loved ones, you may have some concerns. A discretionary trust is just one way you and your Sacramento trust lawyer can ensure the money you leave to your beneficiaries doesn’t get squandered, lost or stolen. The following are some ways you can use a discretionary trust to benefit your loved ones.

Tuition – If you have children or grandchildren who are attending college or who will be in the future, you could designate the trust money to be dispersed only as college tuition after the beneficiary graduates from high school.

Disabilities – A beneficiary who receives disability benefits cannot be denied certain benefits because of the money you leave behind since he or she isn’t absolutely entitled to all of it at any given time.

Divorce – If your loved ones are or will be going through a divorce, a discretionary trust saves that money from being granted to the ex.

Questions To Ask a Potential Trust Lawyer

Is Your Focus Estate Planning?

Only hire a Sacramento trust lawyer whose focus is on estate planning. These specialists are the only attorneys with the skills necessary to ensure your documents are worded effectively. That way, you know your assets will be dealt with precisely as you desire.

How Many Years Have You Practiced?

You want to hire a lawyer with experience. It’s best to find one who has already handled a client’s death so they know their way around the execution process.

Do You Execute Plans?

Some lawyers only draw up the plan, while others offer execution services. We at Yee Law Group are happy to help execute your project, allowing you to know your assets are being taken care of correctly.

Do You Conduct Reviews?

Sometimes, you can ask your Sacramento trust lawyer to review your plan. For a fee, they will see if your project still aligns with your financial situation and make any adjustments for life changes. They will also check if any legislative amendments have affected your plan and could demand changes.

What Tax Experience Do You Have?

You’re going to want to learn the best way to manage your estate taxes. Therefore, you want to find an attorney with experience with this specialty and can help you understand what steps you can take to deal with these.

Can You Create Comprehensive Estate Plans?

A comprehensive estate plan includes your life insurance policies, trusts, and will. Therefore, it is best to go with an attorney who offers this service over one who handles trusts or wills. These individuals will help you decide which estate planning tools are the best for your situation.

What Are Your Fees?

A lot of estate planning lawyers offer flat rates. Others offer a flat rate for essential services and charge additional hourly fees for extra features, such as research. Either way, you want to ask about their fees and payment model before deciding on an attorney.

Do You Use Revocable Living Trusts?

Some individuals may find that putting their assets into revocable living trusts is the best way to get your relatives through the probate process. However, this is not the best option for everyone, even though some lawyers prefer it because they can charge you more for creating one. Fortunately, our staff at Yee Law Group can evaluate your situation and help you discover if this option is best for you.

Charitable Trusts

One of the tools that people have available to them when it comes to estate planning is charitable trusts. Charitable trusts are trusts that are set up in order to benefit some sort of charity or to be used for a charitable purpose. It is important to keep in mind, however, that there are limits to what a charitable trust can do. A Sacramento trust lawyer from Yee Law Group can help.

In order to set up a charitable trust, the charity you choose to donate to must be one that is approved by the Internal Revenue Service (IRS). The charity itself will be acting as the trustee and will manage or invest the assets or property placed in the trust in order to produce an income. The charity may pay the person who set up the trust a percentage of the income that is made from the trust over a timeframe that the two parties have agreed upon. When the person who establishes the trust dies, then the charity becomes the owner of the assets and/or property that is contained in the trust.

What Are the Benefits of Establishing a Charitable Trust?

As a Sacramento trust lawyer can explain, when property is moved into a charitable trust, the trust is allowed to sell that property without having to pay taxes on any capital gains there may be if the property appreciated over the time it was first purchased. Any proceeds from the sale of the property can stay in the trust and those proceeds are also not taxed. Any income tax deductions that are available for the property can be taken by the charity. That deduction is determined by the IRS based on the value of the property and the amount of income received on that property.

Although the tax benefits of a charitable trust are very attractive, there is another reason why charitable trusts are favored by many people and this is because these trust give the person the ability to do something good for an organization. But a Sacramento trust lawyer will also explain that charitable trusts are irrevocable. This means that once a person sets up a charitable trust, they are unable to cancel or change the trust. So, while the person who set up the trust can still obtain an income from the trust for the rest of their life, the contents of the trust cannot be sold or given to an heir. The charity will become the owner of the property of the trust when the person dies.

A Sacramento trust lawyer understands that there are management and administration expenses associated with a charitable trust that should be covered by the trust contents. Many financial professionals recommend that the amount of assets placed in a charitable trust should be worth at a minimum $500,000.

To learn more about how a charitable trust can benefit your estate plan, call Yee Law Group Inc. to meet with a seasoned Sacramento trust lawyer.

Common Myths About Trusts

Establishing a trust can offer many advantages for you and your family. However, before you create a trust, it is important to understand the ins and outs of it. Here are some common myths about trusts that you should not believe:

Trusts are just designed for the rich. Many people are under the impression that trusts are only for wealthy individuals. This just is not true. Trusts can offer advantages for people with average incomes too.

Trusts always help you avoid probate. In many cases, you can skip probate if you have trust. However, if your trust is not created properly, you may still have to go through probate. If you have certain assets that are not in the trust, they will have to go through the probate process. That is why it is critical to have an experienced Sacramento trust lawyer help you set up your trust.

Trusts are too expensive to set up. Some people are reluctant to establish trusts because they think they are too expensive. It is true that it costs more to set up a trust than a will. However, a trust may help you save more money in the long run. For example, it can help save money on taxes.

Trusts don’t offer benefits for grantors. Another myth about trusts is that they only offer benefits for beneficiaries. Although they can help beneficiaries receive their inheritances faster, trusts also offer benefits for grantors while they are still alive. For example, it can provide protection if the grantor becomes physically or mentally disabled during his or her lifetime.

Trusts are just for married couples. Trusts are certainly a beneficial tool for married couples. However, that does not mean single individuals can’t benefit from them too. A trust can help single people ensure that their beneficiaries receive their inheritances as intended.

Responsibilities of Your Trustee

Learn and Follow the Trust Terms

A trustee is responsible for managing the assets in your trust. Initially, you may be the trustee, but upon your death or incapacitation, you should have a successor trustee or successor trustees. For example, you may choose your spouse and/or lawyer as your trustee.

Your trustee is responsible for understanding your trust terms. Your Sacramento trust lawyer can help your trustees learn your wishes. Your attorneys can guide these individuals as they administer your trust and secure your assets. A reputable law firm, such as the Yee Law Group, should also have a list of your trust’s beneficiaries and their contact information.

What Trustees Cannot Do

Your attorney should provide you with a list of things your trustees cannot do. For example, they cannot mix their assets with those in your trust. Therefore, their financial assets, such as their investments and bank accounts, cannot be included in or added to your trust. In addition, the assets in your trust must be treated according to your desires, so your trustee cannot use these assets to their benefit unless you allow this use in your trust documents.

Asset Management and Protection

The attorneys at the Yee Law Group should tell you that your trustees need to manage and protect your assets. This includes investing financial assets in conservative investments that provide growth over time without excessive risk. These individuals need to act as fiduciaries.

Your trustees are also responsible for record-keeping. They need to file taxes each year on the trust’s assets. In addition, they are responsible for sharing the trust’s growth, taxes and other information with your beneficiaries.

Fortunately, trustees can seek professional help, such as that offered by a Sacramento trust lawyer. Trust management can be overwhelming, and if your trustees haven’t managed a trust previously, they can become quickly overwhelmed.

Make Trust-Related Decisions

Your trustees need to execute your trust exactly as you wish. Your Sacramento trust lawyer should help you clearly state your wishes. However, there are times when some assets are not discussed or income from other assets does not have a clear distribution requirement. In these cases, your trustee will need to make decisions about your trust.

In addition, your beneficiaries may need additional distributions. For example, if you have a monthly stipend going to your underaged children, but they need sports equipment one month, requiring an additional distribution, your trustee needs to decide whether these expenses are legitimate. These are considered discretionary decisions.

How a Trust Can Help a Special Needs Child

If you have a special needs child, you want to make sure he or she is taken care of after you’re gone. It can be especially beneficial to establish trust. Leaving your assets directly to a special needs child can prevent him or her from receiving Supplemental Security Income and Medicaid. On the other hand, if you set up a special needs trust controlled by another person, your child can still receive the benefits.

Mistakes to Avoid When Establishing a Trust

A living trust is an important estate planning tool that comes with many benefits. However, if you make even one mistake, your trust might not do what you intend it to. Here are some common mistakes you should avoid when establishing a trust.

- Failing to transfer assets to trust. A living trust is designed to distribute assets to your beneficiaries after your death. However, if your trust is not properly funded, it won’t be able to do this. It is important to transfer title to the asset to your trust by filing the appropriate documents.

- Not appointing the proper successor trustee. When creating a trust, it is important to designate a successor trustee. This person is responsible for managing your trust if you should become incapacitated during your lifetime. As such, you want to appoint someone who is trustworthy, organized, honest and impartial. If you don’t think anyone in your family is up for the task, it may be necessary to appoint a third-party.

- Not appointing backup beneficiaries. It is certainly unpleasant to imagine the death of your loved ones. However, when you are setting up a trust, it’s important to be logical. If one of your beneficiaries happens to die, the trustee will not know what to do with his or her assets. That’s why it is wise to appoint backup beneficiaries in your trust.

- Thinking you can establish a trust by yourself. Although there is DIY software for trusts, you should avoid establishing a trust without professional help. Trusts are complicated legal documents and may include language that you don’t fully understand. If you make an error, your trust will not be valid. It is worth the money to hire an experienced Sacramento trust lawyer. He or she will make sure that your trust is valid and reflects your wishes.

- Failing to update your trust. It is likely that you will need to update your trust at least once in your lifetime. For example, if you get a divorce or your financial situation dramatically changes, you may need to review your trust. If you neglect to make updates, your trust may not function like you intended.

- Not providing clear instructions. When creating a trust, don’t forget to provide clear instructions, like how you want your trust to function and whom your assets should go to.

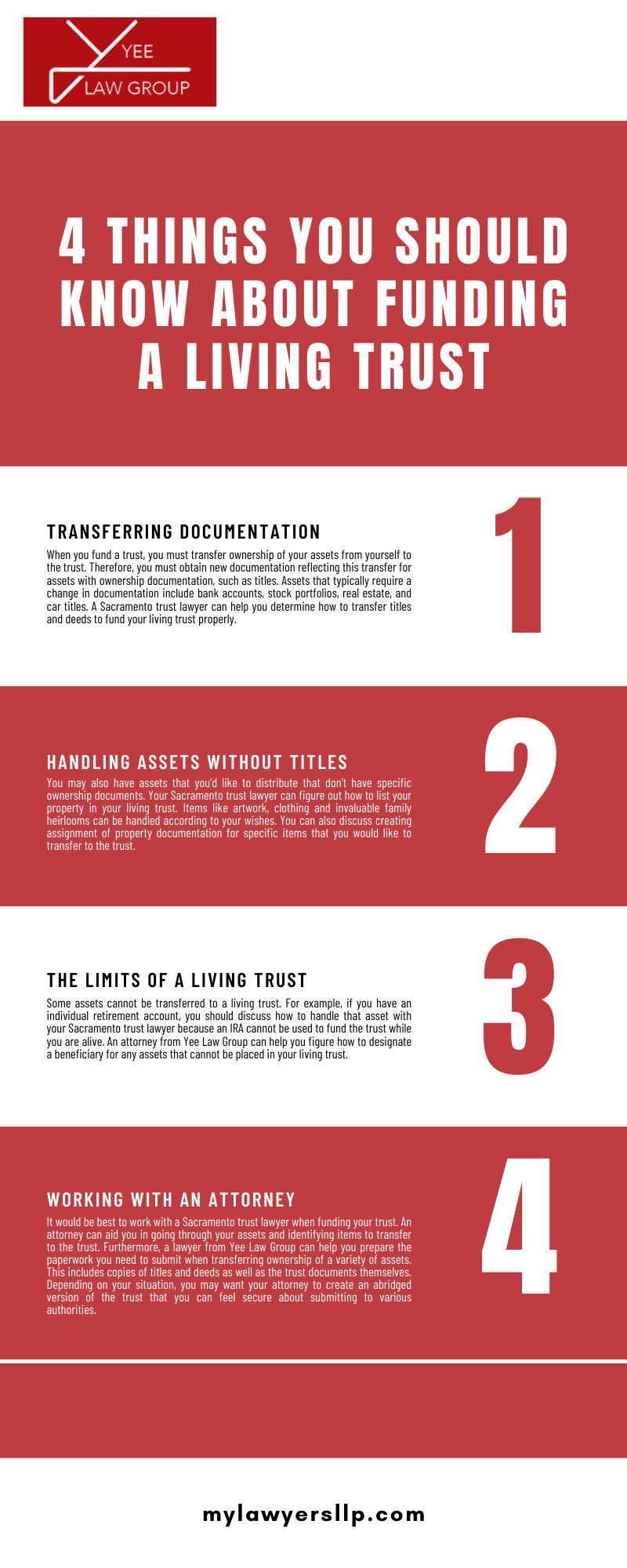

4 Things You Should Know About Funding a Living Trust

A living trust can help you control how your assets are distributed after death. Therefore, it’s important to fund your trust so that your property is handled according to the trust’s specifications rather than being subject to your will or state laws regarding inheritance. Here are four things you should know about funding your living trust.

1. Transferring Documentation

When you fund a trust, you must transfer ownership of your assets from yourself to the trust. Therefore, you must obtain new documentation reflecting this transfer for assets with ownership documentation, such as titles. Assets that typically require a change in documentation include bank accounts, stock portfolios, real estate, and car titles. A Sacramento trust lawyer can help you determine how to transfer titles and deeds to fund your living trust properly.

2. Handling Assets Without Titles

You may also have assets that you’d like to distribute that don’t have specific ownership documents. Your Sacramento trust lawyer can figure out how to list your property in your living trust. Items like artwork, clothing and invaluable family heirlooms can be handled according to your wishes. You can also discuss creating assignment of property documentation for specific items that you would like to transfer to the trust.

3. The Limits of a Living Trust

Some assets cannot be transferred to a living trust. For example, if you have an individual retirement account, you should discuss how to handle that asset with your Sacramento trust lawyer because an IRA cannot be used to fund the trust while you are alive. An attorney from Yee Law Group can help you figure how to designate a beneficiary for any assets that cannot be placed in your living trust.

4. Working With an Attorney

It would be best to work with a Sacramento trust lawyer when funding your trust. An attorney can aid you in going through your assets and identifying items to transfer to the trust. Furthermore, a lawyer from Yee Law Group can help you prepare the paperwork you need to submit when transferring ownership of a variety of assets. This includes copies of titles and deeds as well as the trust documents themselves. Depending on your situation, you may want your attorney to create an abridged version of the trust that you can feel secure about submitting to various authorities.

For your living trust to carry out its intended purpose, you must figure out how to transfer ownership of your assets to your trust. An attorney can assist you with multiple aspects of funding your living trust.

4 THINGS YOU SHOULD KNOW ABOUT FUNDING A LIVING TRUST INFOGRAPHIC

Sacramento Trust Lawyer

Deciding to set up a trust is a big step, and finding a Sacramento trust lawyer is someone that you should consider looking for during this process. However, a lawyer isn’t the only thing that you should look for. You are going to need a trustee and it is vital that you select an appropriate trustee to administer your trust. It isn’t an easy process to go through, and it is one that can be daunting.

If you are starting your journey you should know what goes into a good trustee. Read below to find out more about how to find the right trustee for you.

Quality of a Good Trustee

While the duties of a trustee are going to vary depending on the type of trust being administered and your wishes, there are several qualities that each trustee must display in order to be right for the job. It can be difficult but here are the qualities to look for:

- Willingness – Before you find a trustee you need to know that your trustee is willing to understand their duties. Serving as a trustee can be difficult and complex and even those who receive compensation may think twice about wanting to perform those duties. If your trustee is having doubt about being able to perform their duties, talk with them. It is always important to select a willing trustee who is willing to do what is necessary to administer your trust, even if it upsets people.

- Time – Simply by their nature there are certain types of trusts that involve a significant time commitment. Many trustees may find themselves administering a trust for years. That is why you need to find someone who has the time to commit to this. Also, if you are expecting your trustee’s duties to last for many years you may not want to select someone who is already of advanced age.

- Reliability – You need someone who is going to be reliable. There is far too much at stake to select someone who isn’t reliable. While things do come up you need someone who is just as committed to this as you are.

- Unbiased – When selecting a trustee you need someone who has no conflict of interest in administering your trust. They are legally and ethically bound to act only in the best interests of your beneficiary with no considerations for personal gain. If you have any doubt then you need to consider another trustee.

- Organized – Administering the duties of a trustee can be a complex job. This is why it takes someone with the utmost organizational skills to make sure everything goes as planned. This allows them to avoid making mistakes and fulfilling all requirements necessary for legal compliance.

- Trust – It is in the name. You have to trust your trustee to do what is right for you. If there is any doubt in this, then find another person to take on the role.

If you are wanting to make a trust then it is in your best interest to find a Sacramento trust lawyer like the ones here at Yee Law Group.

When do you need a trust lawyer?

There are many times when a trust lawyer is needed. The most common reason people hire trust lawyers is to form or manage trusts. You may also need a trust lawyer’s help for many other reasons. Sacramento trust lawyers are especially useful when setting up conservatorships for loved ones or if you need help with estate planning. They can also assist in bankruptcy and probate cases. It is always best to consult with an experienced trust lawyer if you have questions about trusts or other legal matters related to estates.

A Sacramento trust lawyer will be able to help answer any questions and concerns you may have about what steps can be taken before something happens or if something has already happened. A trust lawyer will also be able to serve as a valuable resource for other related matters such as estate planning, wills, probate law, Medicaid & SSI eligibility, and more.

Here are some common situations in when you should seek out the services of a trust lawyer:

- You’re trying to figure out how much money your estate will generate or what it’s worth

- You need to update your living will or power of attorney document

- You want to make sure that your beneficiary designations on retirement accounts won’t be overridden by beneficiaries named in your will

- Your child needs guidance managing their inheritance because they don’t know where all their wealth came from

When it comes to your trust law needs, you want an attorney who is both knowledgeable and experienced. Yee Law Group has been protecting families for almost three decades. We know how important it is to create a strong foundation that will help the next generation grow, thrive, and prosper. Our team of attorneys is committed to providing personalized attention to our clients while meeting their legal needs with integrity and professionalism. Contact us today for more information on how we can help you!

Exploring Different Kinds of Trusts

There are two primary kinds of trusts: revocable and irrevocable. Revocable trusts may be modified and “canceled” at the wish of the trust creator. Irrevocable trusts cannot be modified or canceled under most circumstances. Within these two broad categories of trusts, there are several varieties of each. Trusts may be structured to provide for a child’s educational expenses or to pass along certain assets subject to conditions. For example, a grandparent could leave a sum of money to a grandchild that will only be extended once the grandchild reaches a certain age.

Trusts may be set up to provide for the needs of disabled individuals, pets, charitable organizations, and a host of other beneficiaries. Trusts may be structured so that they come into effect during a creator’s lifetime or upon their death. Our firm can explore any and all trust types that may be applicable to your needs, goals, and estate planning priorities.

Legal Assistance Is Available

If you have not yet explored the variety of estate planning tools available to you, connect with the experienced California legal team at Yee Law Group to learn more. Creating a will can be an excellent way to ensure that your loved ones understand your wishes in the event of your death. However, wills cannot accomplish many important aims, including the minimization of tax liability, expression of end-of-life medical care concerns, and the transfer of assets during an individual’s lifetime. By exploring different kinds of trusts and a host of other estate planning tools available to you, you’ll place yourself in the best position to make your end-of-life care and the transfer of your assets upon your death as low-stress and as reflective of your wishes as is possible. Our team looks forward to speaking with you.

Why Hire Yee Law Group as your Trust Lawyer

Trust is the foundation of every relationship. It’s what keeps people together, businesses running and communities strong. But trust can be fragile. In fact, it takes less than one percent of a person’s assets to ruin their lives if they lose it all in a divorce or estate fight that goes wrong.

Yee Law Group helps protect your family and business from predatory lawyers using our legal services agreements for families and businesses as well as our mediation services for divorces and other disputes between clients and their attorneys. We’ve helped thousands of clients avoid costly mistakes by working with them to create customized legal documents that provide protection against financial predators while preserving the client-attorney relationship when needed most.

You can rest easy knowing that we are here to provide expert advice on all matters related to trusts, wills, and estate planning. Whether it’s creating a revocable living trust or setting up an irrevocable trust with special provisions, our Sacramento trust lawyer will make sure that your assets are protected from future lawsuits or creditors after death. We also offer assistance with probate proceedings and administering trusts when necessary. If there is anything else you require help with regarding trusts, don’t hesitate to reach out today!

Hire Yee Law Group as your Sacramento trust lawyer starting today! We’ll make sure that your company’s legal affairs are in order from day one so that you can focus on what matters most – growing your business!

Client Review

“Mike Yee and his team are amazing. They are fast and efficient, but you don’t feel rushed at all when meeting with them. Mike in particular is extremely patient, knowledgeable and articulate, and made the whole process as pleasant as writing legal documents can be. Highly recommended.”

Gerald Quon