Sacramento Probate &

Estate Planning Attorneys

INCORPORATING TIMELESS VALUES AND THE EXPERIENCES OF THE PAST TO REACH

THE BEST POSSIBLE OUTCOMES FOR OUR CLIENTS TODAY AND IN THE FUTURE.

At Yee Law Group Inc., clients can expect their attorney to take a vested interest in their success, working efficiently to solve problems that stand in the way and adding value by developing and implementing efficient and cost – effective strategies that lead to optimal results.

Taking the time to truly listen as well as advise, we provide sound and sophisticated counsel that encompasses international and domestic matters across a broad range of business and estate planning disciplines.

What You Need to Know About Estate Planning in Sacramento CA If you have questions, or would like to make …

Probate Lawyer Sacramento, CA To effectively manage the estate of a loved one, you may want to hire a probate …

Your Lawyer Should Know As Much About You As They Do About the Law

You expect your lawyer to know the law. A truly exceptional lawyer, however, understands that the law is not only about books, cases, and statutes – it’s about people. At Yee Law Group Inc., we never lose sight of that fact. Our committed team provides exceptional and personalized representation focused on each clients’ unique circumstances, concerns, and goals.

Sacramento Probate Attorneys &

Estate Planning

SOPHISTICATED COUNSEL FOCUSED ON SOLVING PROBLEMS

Practice Areas

Sacramento CA Will Lawyers Getting your affairs in order is an important component in making sure that your loved ones …

When you hire a living trust lawyer Sacramento CA offers, you may be able to save on taxes or arrange …

If you want to leave your belongings to your loved ones after you pass, you may want to talk to …

Wealth Transfer Taxation Lawyer Sacramento, CA If you are looking for a skilled wealth transfer lawyer who will be able …

Business Succession Planning Lawyer Sacramento, CA A Business Succession Lawyer Sacramento, CA Trusts Discusses Issues Every Business May Face At …

Conservatorship Lawyer Sacramento, CA When you are feeling confused or overwhelmed about a probate matter, you should contact a knowledgeable …

FAQ

In broad terms, a will is a legal document that states how you want your financial assets and property to be handled after your death. You name an executor, who oversees distributing your property, and beneficiaries, who will receive your property. You can also name permanent guardians for your minor children. Generally, wills that transfer ownership of the testator’s real and personal property to living beneficiaries go through probate.

A revocable living trust is a legal entity you create during your lifetime. Any property you choose to place into the trust will be distributed according to its terms after your death. Just like a will, you name someone to manage distributions (the trustee) and the people who will receive your property (beneficiaries).

Unlike a will, however, a revocable living trust does not have to go through the probate court to be executed. In California, the probate court process can take 12-16 months to complete, costs approximately 5% of the value of the estate in court fees, and is completely public. Creating a revocable living trust saves your loved one’s time, and money, and maintains your privacy.

Every Estate Plan includes:

- A Will or Revocable Living Trust (as appropriate),

- A Pour-Over Will, to catch any assets accidentally left out of the Trust,

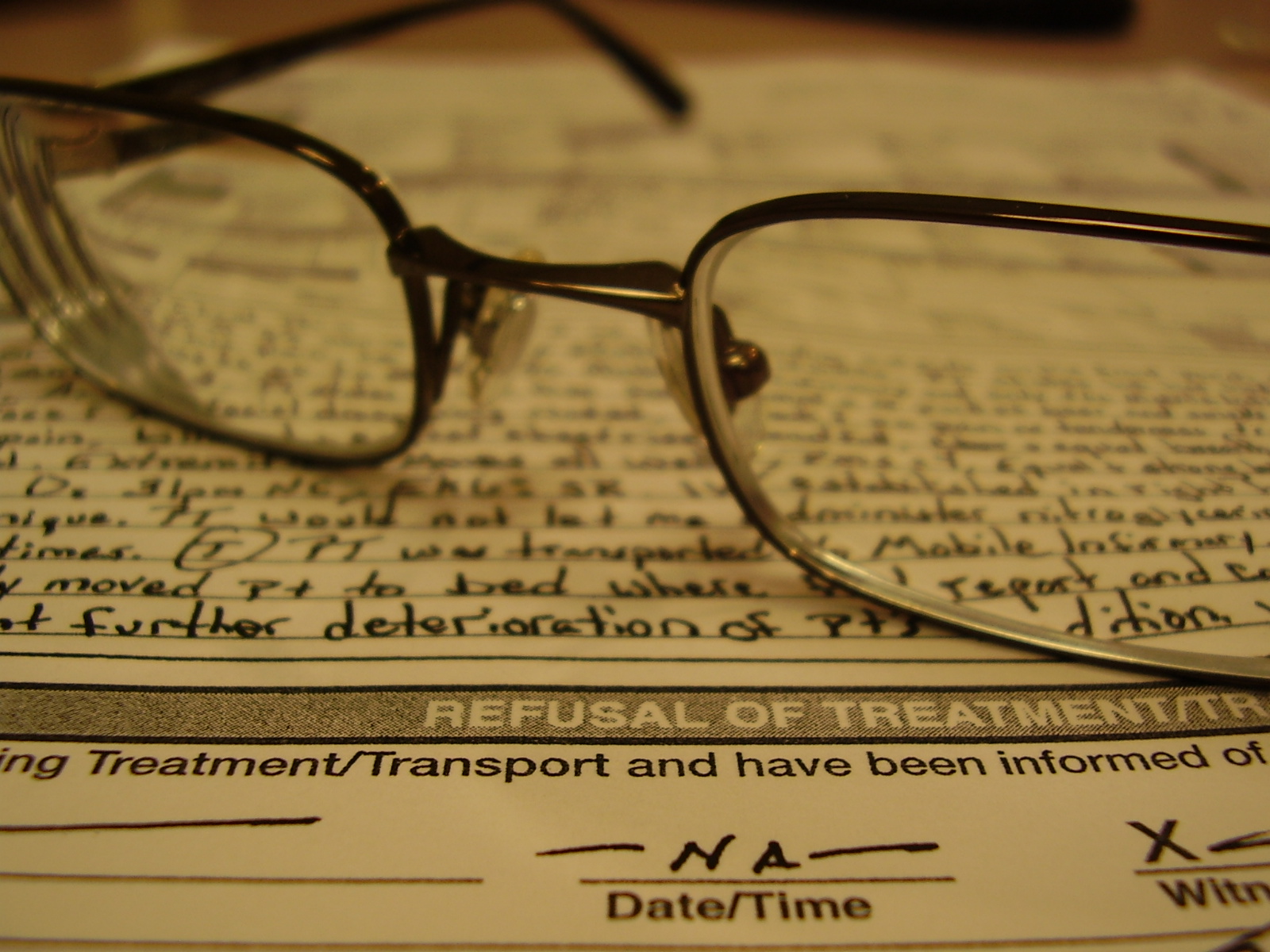

- A Financial Power of Attorney, designating someone to act on your behalf for financial matters when you are ill or otherwise incapacitated,

- An Advanced Health Care Directive, naming the person who could make medical decisions on your behalf if you were unable to communicate,

- A HIPAA Waiver, granting access to confidential medical information to your chosen representatives

The first important way to protect minor children is by naming potential permanent guardians to care for them if you are no longer able.

A revocable living trust can also be crafted to ensure that a minor child’s inheritance will be both supervised and protected from future creditors, court judgments, and divorce proceedings.

In California, a family’s home is often its largest investment. If you own a home with a fair market value of more than $61,500 (meaning what the home would sell for, regardless of debt), your family will need to go to court to inherit the house, unless you plan ahead.

The court process, called probate, in CA costs on average 5% of the total value of the estate, is totally public, and delays distribution to your heirs for 12-16 months, minimum.

If you have minor children at home, planning is a must. If you could no longer care for your children and had no estate planning in place, the court would decide who should raise them and appoint a fiduciary to manage their inheritance, for a fee. Then, when they turn 18, the remaining inheritance would be distributed to them outright, without any guidance or supervision. Your Estate Plan will be crafted to avoid this outcome, giving you the most possible influence on your children’s futures.

When you plan with Yee Law Group, we will have two important meetings. The initial meeting can be held via videoconference, from the comfort and convenience of your home or office, or can be over the phone or in person. The entire process takes five to six weeks.

The first meeting is the Design Meeting, where you decide the specifics of your estate plan distributions. We will email you drafts of all your documents at least two weeks prior to your Delivery Meeting to review at home which gives you enough time to review all the documents and schedule an additional consultation if you would like to go over the documents and any questions you may have. The final meeting is the Delivery Meeting, where you will sign all the documents in the presence of a notary and receive your complete Estate Plan Binder and a digital copy.

You have 1 year from the Delivery Meeting to make any changes to your existing plan at no additional cost. Any changes after the 1 year there would be some minimal fee depending on the changes requested.

The first step is to contact our office to schedule a free consultation and you will need to fill out our initial questionnaire which I will use during the consultation to help design your personal estate plan!

Please be advised that our law practice no longer handles business and real estate matters. The information provided on our website regarding these areas of law is intended for informational purposes only and should not be considered as legal advice.

However, we can offer referrals for business and real estate legal services. Additionally, we are available to provide advice on business and real estate matters as they relate to estate planning.

We appreciate your understanding and continued trust in our services. For any inquiries or assistance with estate planning or related matters, please do not hesitate to contact us.

Currently we charge a flat fee of $2,300.00 for a single-person estate plan package and $2,600.00 for a married couple’s estate plan package.