Estate Planning Lawyer Roseville, CA

Dedicated Assistance With Your Estate Plan

Individuals who are searching for our Roseville, CA estate planning lawyer might already know that estate planning can be very complicated. It is common to feel a great deal of pressure to make the best possible decisions for how your property should be passed along and inherited by remaining relatives. At Yee Law Group Inc., we know that estate planning can seem very stressful at first. That’s why we’re here to help simplify the process and clarify your wishes with a customized, comprehensive plan.

If you have not yet scheduled a risk-free consultation with our team, please do so now. Whether you have some estate planning documentation in place or you’re starting from scratch, we can assist you with all of your needs both now and moving forward. If you invest the time required to get the process of executing a comprehensive, current estate plan rolling, we’ll do our utmost to make this process as efficient, effective, and low-stress as possible. We look forward to speaking with you, so set up an appointment with our estate planning lawyer in Roseville today.

Estate Planning Basics

An estate, in its broadest sense, encompasses all the assets, properties, and personal belongings a person accumulates throughout their life. This includes real estate properties, stocks, bonds, bank accounts, personal possessions, and even digital assets. The concept of an estate becomes particularly significant when discussing matters of inheritance and the legal distribution of these assets upon an individual’s passing. In our professional experience as an estate planning lawyer in Roseville, CA, we have come to realize that managing an estate requires a nuanced understanding of various legal aspects, including property law, tax law, and trust and estate law. Our role is to provide guidance and legal services to individuals and families in planning their estate, ensuring that their wishes are respected and carried out efficiently after their passing.

One of the most critical aspects of estate management is the creation of a will or living trust. These legal documents spell out an individual’s preferences regarding how their assets should be distributed among heirs and beneficiaries. We focus on tailoring these documents to reflect our client’s unique situations and wishes. Furthermore, we also deal with the complexities that arise during estate administration. This involves guiding executors and beneficiaries through the probate process, a court-supervised procedure where the deceased’s estate is appraised, debts are paid off, and the remaining assets are distributed as per the will or state law in the absence of a will. Our role often extends to offering counsel on minimizing estate taxes and resolving disputes that may arise among beneficiaries. It’s a responsibility that requires not just legal expertise but also a deep sense of empathy and understanding of family dynamics.

The Benefits Of A Comprehensive Estate Plan

Ensured Asset Protection And Distribution

A well-thought-out estate plan ensures that your assets are distributed exactly as you intend. This strategic planning can significantly reduce the likelihood of family disputes over inheritance, maintaining harmony and respecting your final wishes.

Minimization Of Taxes and Legal Fees

Estate plans, particularly those involving trusts, can be structured to minimize the tax burden and legal fees that might otherwise diminish the value of your estate. This careful planning ensures maximum preservation of your assets for your beneficiaries.

Comprehensive Planning For Incapacity

By including powers of attorney and healthcare directives in your estate plan, you ensure that both your financial and healthcare decisions are made according to your preferences, even if you’re incapacitated. This foresight offers peace of mind and prevents potential legal complications during difficult times.

Assurance For Minor Children’s Future

Guardianship designation is a cornerstone for parents in estate planning, providing the assurance that their children will be raised by chosen guardians, reflecting their parenting ideals and values.

Avoidance Of Probate Process

Certain aspects of an estate plan, notably trusts, can circumvent the often lengthy and public probate process. This can offer a smoother transition of assets to beneficiaries while maintaining privacy and reducing administrative burdens.

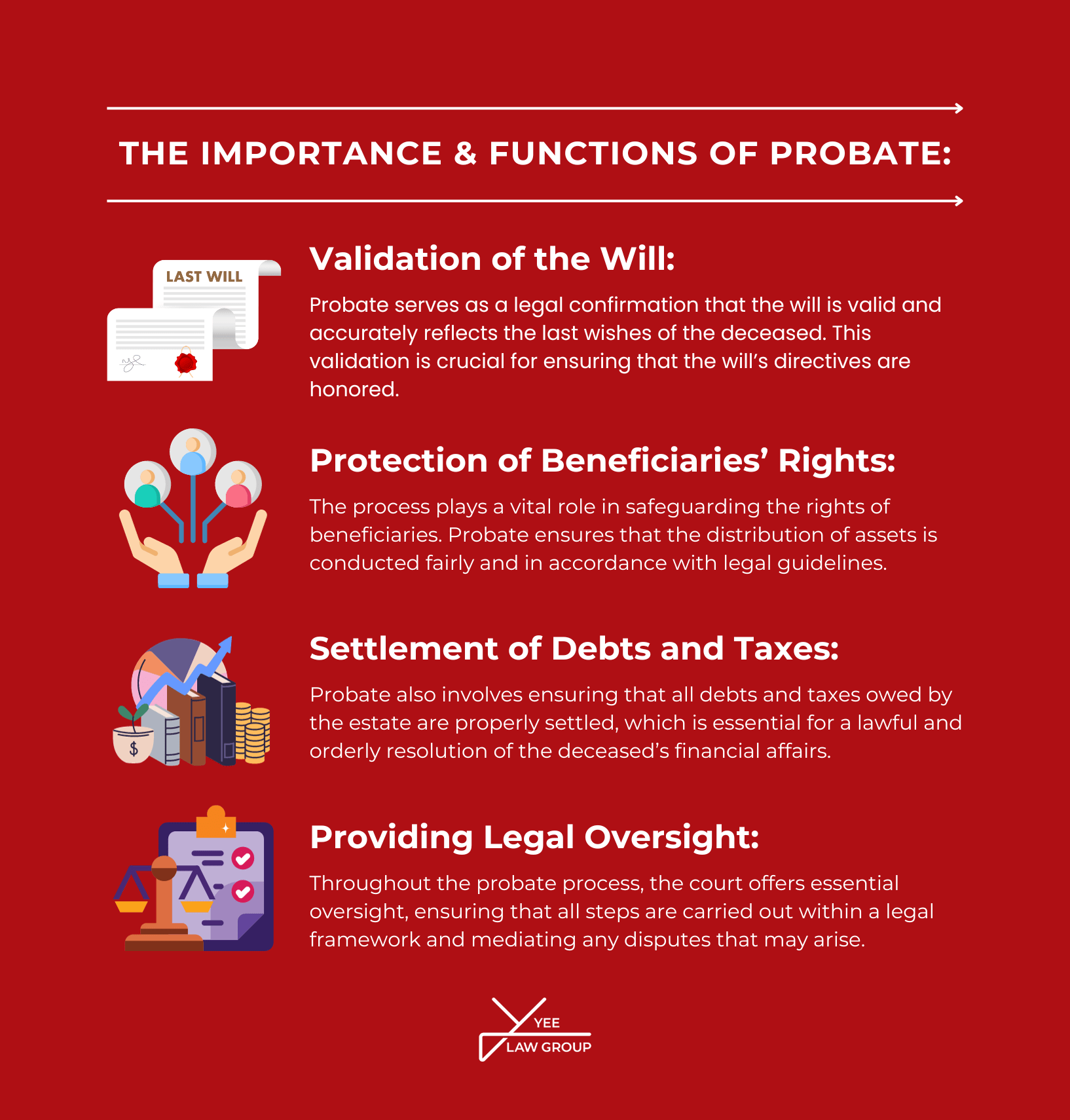

The Importance And Functions Of Probate

Probate serves as a legal confirmation that the will is valid and accurately reflects the last wishes of the deceased. This validation is crucial for ensuring that the will’s directives are honored. The process plays a vital role in safeguarding the rights of beneficiaries. Probate ensures that the distribution of assets is conducted fairly and under legal guidelines. Probate also involves ensuring that all debts and taxes owed by the estate are properly settled, which is essential for a lawful and orderly resolution of the deceased’s financial affairs. Throughout the probate process, the court offers essential oversight, ensuring that all steps are carried out within a legal framework and mediating any disputes that may arise.

Important Components Of The Estate Planning Process

An estate plan, a comprehensive strategy for managing one’s assets and responsibilities, plays a crucial role in ensuring financial security and peace of mind for both the individual creating it and their loved ones.

- Wills & Trusts

At the heart of every estate plan lies either a will or a trust, each playing a pivotal role in asset distribution after one’s passing. A will is a formal document that clearly outlines your wishes regarding the distribution of your assets. It specifies beneficiaries and what they are to receive. In contrast, a trust offers a more nuanced control mechanism. It not only designates beneficiaries but also allows you to set specific terms for how and when your assets should be distributed. Trusts can be particularly beneficial for complex estate planning, offering flexibility and often more privacy than a will.

- Power of Attorney & Managing Financial Affairs

This critical legal document empowers another individual, usually a trusted friend or family member, to handle your financial affairs if you’re rendered incapacitated. The appointed person, or attorney-in-fact, is given authority to make financial decisions on your behalf, ensuring continuity in managing your financial obligations and investments.

- Healthcare Directive

Also known as a living will, a healthcare directive is a document that specifies your preferences for medical treatment should you become unable to communicate these wishes yourself. This directive guides your loved ones and healthcare providers in making decisions aligned with your values and choices regarding life-sustaining treatments and end-of-life care.

- Guardianship Designations & Protecting Minor Children

For parents with minor children, appointing a guardian is an indispensable part of estate planning. This designation outlines your preferred choice for their guardianship in the event of your absence. It ensures that your children will be cared for by individuals who align with your parenting philosophies and values.

Roseville Estate Planning Infographic

Estate Planning Statistics

According to a 2022 survey by the National Endowment for Financial Education, almost 70 percent of Americans do not have an estate plan. This means that over 160 million adults in the US do not have a will, trust, or other estate planning documents in place to address what should happen to their finances when they pass away. Don’t let that happen to you. Contact a Rosevilleestate planning lawyer to ensure your family’s future is protected when you are no longer here. Additionally, according to another study by caring.com, 2 out of 3 adults still don’t have a will. If you need assistance planning out your estate, our firm may be able to help. We always consider the needs and best interests of our clients to be a top priority. Our legal team helps clients plan out their estates so that their assets are transferred into the right hands when it’s time.

FAQs

What is a Living Trust and How Does it Differ from a Will?

A living trust is a legal document created during an individual’s lifetime where assets are placed under the trusteeship for the benefit of the trust beneficiaries, which can be managed and distributed without going through probate. Unlike a will, a living trust is effective during the individual’s lifetime and can provide privacy, as well as potentially save time and money. It differs from a will in that a will becomes effective only after death and typically requires probate to execute.

Can Estate Planning Help in Reducing Estate Taxes?

Yes, estate planning can play a crucial role in reducing estate taxes. Strategies like gifting assets during your lifetime, setting up specific types of trusts, and making charitable donations can effectively reduce the taxable value of your estate. Each strategy has different implications and benefits, making it important to consult with an estate law professional to tailor a plan that suits your specific financial situation.

What Happens if Someone Dies Without an Estate Plan or Will?

If a person dies without an estate plan or will (intestate), their assets are distributed according to state intestacy laws. These laws vary by state but generally prioritize spouses, children, and other family members in a specific order. Without a will, the court will appoint an administrator to handle the estate, which can lead to a longer and potentially more contentious probate process.

How Can I Ensure My Digital Assets Are Included in My Estate Plan?

Including digital assets in your estate plan involves specifying how you want these assets to be handled, including online accounts, social media profiles, digital photos, and other digital properties. It’s important to provide your executor or trustee with access to these assets, including passwords and other necessary information, and to include specific instructions in your estate planning documents regarding how they should be managed or distributed.

Is Estate Planning Necessary for Young Adults or People with Modest Assets?

Yes, estate planning is important for everyone, regardless of age or asset level. Young adults and people with modest assets can benefit from having a will, healthcare directives, and possibly a power of attorney. These documents can ensure that your wishes are respected in case of unexpected events and can provide clear guidance to your loved ones, alleviating additional stress during difficult times.

Yee Law Group Inc., Roseville Estate Planning Lawyer

919 Reserve Dr, Roseville, CA 95678

Contact Our Firm Today

When you want to leave a legacy and take care of your loved ones, you may be considering creating an estate plan. Unfortunately, many people believe they are not in the position to write an estate plan. Perhaps you are not rich, do not own multiple pieces of property, or are concerned about how time-consuming creating an estate plan can be. These are all valid thoughts and concerns. However, we encourage you to stop and think about what you do have to offer your loved ones. Maybe you own a home, a car, a special antique coin collection, or valuable stamps.

Client Review

“Mike Yee and his team are amazing. They are fast and efficient, but you don’t feel rushed at all when meeting with them. Mike in particular is extremely patient, knowledgeable and articulate, and made the whole process as pleasant as writing legal documents can be. Highly recommended.”

Gerald Quon