Living Trust Lawyer Roseville CA

If you’re interested in talking with a living trust lawyer Roseville, CA offers, contact the Yee Law Group Inc.. Our California attorneys have a thorough understanding of estate law and its complexities. When you work with one of our lawyers, you will have the confidence of knowing that your best interests are protected.

Contact us today to arrange for a free consultation with a living trust lawyer in Roseville, CA. If you have questions or concerns about the process of creating a living trust, we will be happy to address them. For general information, the following may be of interest to you.

Table Of Contents:

- The Purpose of a Living Trust

- Why Set Up A Living Trust?

- About Living Trusts

- Reasons To Set Up A Living Trust

- What Are The Benefits of a Living Trust?

- What Assets Are Assigned In A Living Trust

- Living Trust Agreements

- Living Trusts and Wills

- Hiring a Living Trust Lawyer Roseville CA Counts On

- Yee Law Group Inc.

- Contact Yee Law Group Inc. Today

The Purpose of a Living Trust

Living trusts are written documents that specify how a person’s assets should be managed and controlled while they’re alive, and after they are deceased. They usually are not a substitute for a will but are instead used in addition to a will. They can be administered by the asset owner, or by someone they designate to be the trustee. A Roseville living trust lawyer can structure a living trust to fit your needs.

Why Set Up A Living Trust?

Nobody wants to think about becoming ill or passing away, but it is important to plan for the future so that loved ones and heirs will receive the money and property entrusted to them after death. Working with a living trust lawyer serving Roseville, CA ensures the transfer of property in a timely manner without going through the process of probate.

About Living Trusts

A living trust is an estate planning tool that helps one manage a property and ensures that assets will go to a beneficiary after death in a timely manner. This type of trust is created during the grantor’s lifetime. It is created by the grantor, who entrusts property to a trustee to benefit a beneficiary. A person will usually have the help of a living trust lawyer for Roseville, CA, like one from Yee Law Group Inc.. The person who receives the assets in the trust fund at the time of the grantor’s death is called the beneficiary. Property and assets in the trust fund are managed by the trustee until the time of the grantor’s death. The grantor usually chooses to be the trustee while still living, but assigns another person to be the new trustee upon his or her death. Any competent family member or trusted adult may take over the role of trustee, but wealthier grantors may opt for a bank or trust corporation to adopt the position. The grantor may also alter or revoke the trust at any point in his or her lifetime; this is why living trusts are also sometimes called revocable trusts.

Reasons To Set Up A Living Trust

There are many reasons one may decide to set up a living trust, with the help of a living trust lawyer in Roseville, CA. The most common reason for setting up a living trust is to avoid California probate proceedings. Probate proceedings consist of the distribution of assets to heirs upon one’s (the grantor’s) death. Probate is a court process that occurs when a person has not appointed property to an individual after his or her death. All property listed in the living trust avoids probate completely because, upon the grantor’s death, the trustee transfers the property to the beneficiary. Once the entire property in the trust has been transferred to the beneficiary, the trust no longer exists.

By avoiding probate, with the assistance of a Roseville, CA living trust lawyer, the living trust:

- Saves time. It usually takes the beneficiary a few weeks to receive the assets of the trust after the grantor’s death with a living trust, versus months that it may take to receive property via court hearings without a living trust.

- Saves money. Going through probate involves numerous court fees and attorney fees, which could be evaded entirely with a living trust. The assets to be distributed are often greatly diminished after court hearings.

Other reasons to set up a living trust include:

- Tax reduction. More complicated living trusts that include many assets may greatly reduce estate taxes. An example of tax reduction in a living trust would be an AB Trust, which is created for married couples with children. If one spouse passes away, then the living spouse receives the property of the trust. When the living spouse dies, the interest of all the property is passed to the children, which can potentially save substantial amounts of money in estate taxes.

- Ensured privacy of finances. All documents that go through probate are eventually made public record. Since living trusts evade probate entirely, they never become public records and financial privacy may be maintained.

When Should I Consider A Living Trust?

Now. A living trust is a valuable tool that helps individuals have greater control over their assets and when they die they will have their wishes carried out. A living trust is useful when it comes to saving the expense and delay of probate. Probate can usually last as long as three years and take up to 10-15% of the individual’s estate’s value.

Most often, people associate living trusts and wills with dying and being older. However, it is good to consider this type of estate planning even if you are young and healthy. In fact, planning your estate while you are healthy might be the best decision because you clearly understand what you want and can make sound financial decisions. These decisions will ensure:

- Your estate and/or asset directions are carried out when you are gone.

- Guidance to your dependents on how to efficiently distribute your assets.

- Resolutions on any conflicts that arise over the distribution of your assets when you are gone.

Considering a living trust to go alongside your will is excellent preparedness and could save your family a lot of stress when you are no longer alive.

What Are The Benefits of a Living Trust?

You will always have control of your assets and estate when deciding to properly draft a revocable living trust. This is just a glimpse at the benefits of working with a living trust lawyer in Roseville, CA, like the law firm Yee Law Group Inc.. Here are some other benefits could also be worthing the consideration:

- You will save cash. The probate process can be costly and avoiding the courts will save you money.

- Your mind will be at ease. You won’t have to worry about how your estate and assets will be distributed when you are gone. A living trust will give clear direction on how your assets will be distributed. It will reduce stress for your loved ones.

- You will avoid probate. You won’t have to deal with a judge deciding the fate of your assets when you are deceased. A living trust gives you the authority to distribute your assets as you see fit.

What Assets Are Assigned In A Living Trust

A living trust can be named the beneficiary of certain assets and that means those assets would flow directly to the named beneficiary regardless of what has been stated in a will. These assets include employer-sponsored retirement accounts like 401(K)s, individual retirement accounts (IRAs), life insurance policies, and certain bank accounts such as Payable on Death (POD) accounts.

Living Trust Agreements

When you meet with a living trust lawyer Roseville, CA residents recommend, you can discuss any special needs or concerns you may have. Many living trust agreements have these common traits:

- The trustee is usually the owner of the assets or someone the owner has confidence in.

- The trustee has the legal right to control and manage the trust’s assets.

- After the assets’ owner dies, the trustee names the charities and/or individuals who are the beneficiaries of the trust’s assets.

- The trustee manages the trust to benefit the owner, and as such cannot use the trust’s assets for their own personal benefit without the owner’s permission. You can specify to a living trust lawyer Roseville, CA provides under what, if any, circumstances the trustee can access the assets for their own purposes.

Living Trusts and Wills

Living trusts are not intended to take the place of a will; rather, they are designed to be drawn up in addition to a will. A living trust lawyer Roseville, CA locals rely on for estate planning can provide more details specific to your situation. Here are some general guidelines:

- A will focuses on assets you own at the time of your death that is not included in your living will.

- A will usually provide that your non-living trust assets will transfer to your living trust manager after your passing.

- A will can specify who is to be a guardian of your minor children.

- A will may provide additional guidance on estate matters that are not included within the living trust.

If you are interested in creating a living trust, you may want to consult with an experienced living trust lawyer Roseville CA relies on from Yee Law Group. A living trust allows you to place your assets in a safe location so that they may be passed on to your beneficiaries when you pass. While it’s not absolutely necessary to have a living trust, at Yee Law Group we’ve found that many clients do benefit from drafting one.

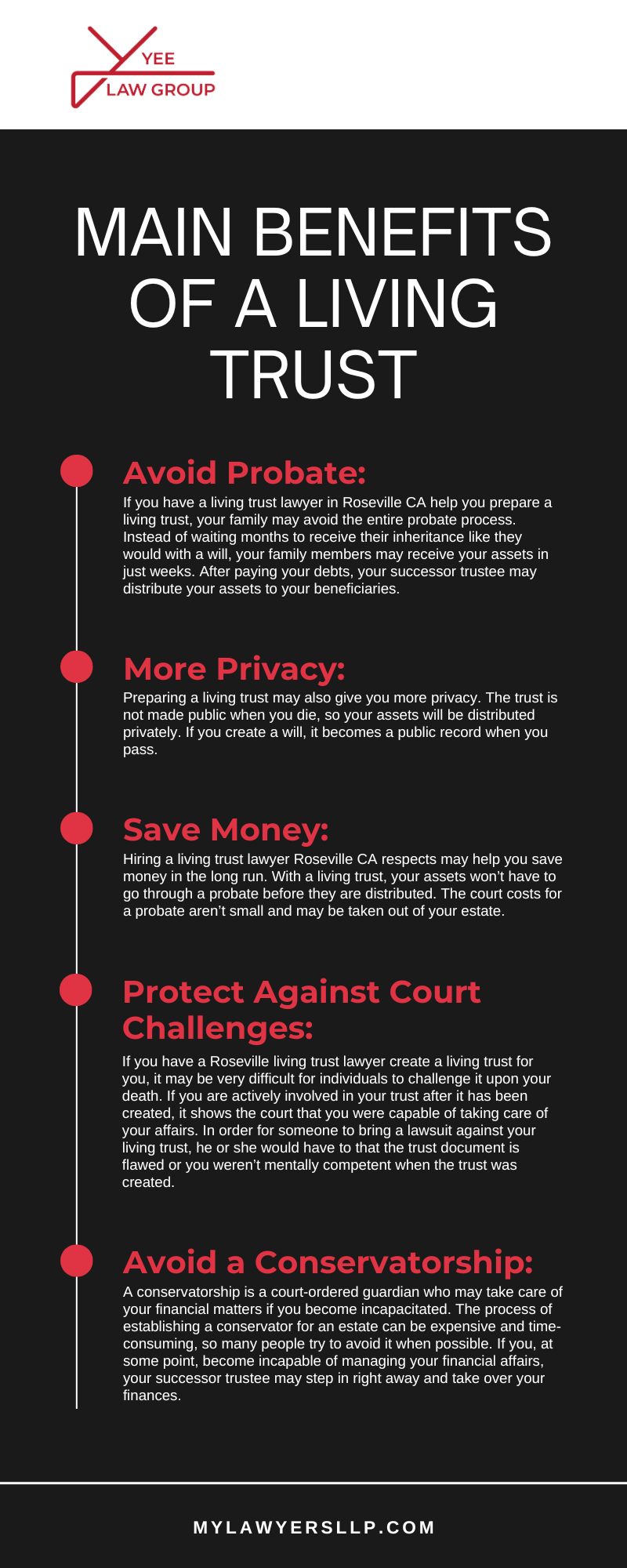

Here are some of the main benefits you may discover when you create a living trust:

Avoid Probate:

If you have a living trust lawyer in Roseville CA help you prepare a living trust, your family may avoid the entire probate process. Instead of waiting months to receive their inheritance like they would with a will, your family members may receive your assets in just weeks. After paying your debts, your successor trustee may distribute your assets to your beneficiaries.

More Privacy:

Preparing a living trust may also give you more privacy. The trust is not made public when you die, so your assets will be distributed privately. If you create a will, it becomes a public record when you pass.

Save Money:

Hiring a living trust lawyer Roseville CA respects may help you save money in the long run. With a living trust, your assets won’t have to go through a probate before they are distributed. The court costs for a probate aren’t small and may be taken out of your estate.

Protect Against Court Challenges:

If you have a Roseville living trust lawyer create a living trust for you, it may be very difficult for individuals to challenge it upon your death. If you are actively involved in your trust after it has been created, it shows the court that you were capable of taking care of your affairs. In order for someone to bring a lawsuit against your living trust, he or she would have to that the trust document is flawed or you weren’t mentally competent when the trust was created.

Avoid a Conservatorship:

A conservatorship is a court-ordered guardian who may take care of your financial matters if you become incapacitated. The process of establishing a conservator for an estate can be expensive and time-consuming, so many people try to avoid it when possible. If you, at some point, become incapable of managing your financial affairs, your successor trustee may step in right away and take over your finances.

Roseville Living Trust Infographic

Hiring a Living Trust Lawyer Roseville CA Counts On

If you have made the decision to create a living trust, you may want to make an appointment to see a skilled living trust lawyer Roseville CA depends on. A living trust may help you define certain aspects of your finances, such as who you want to take over as trustee upon your death and who you want to receive your assets when you pass.

If you’re ready to learn more about establishing your own living trust, the team at our firm is happy to speak with you in person. To speak with a reputable living trust lawyer Roseville CA offers, contact Yee Law Group at 916-599-7297.

Yee Law Group Inc.

Creating a living trust may be one of the best things you can do for your peace of mind. Allow a trusted legal professional to help you protect your future. At the Yee Law Group Inc., a living trust lawyer Roseville, CA community members turn to may assist you too.

Contact Yee Law Group Inc. Today

There are many advantages of setting up a living trust, and the fees and time needed to create one are far less than those incurred by family members after one’s death. Our living trust lawyers are here to help clients to ensure that all heirs receive all property without going through the process of probate. If you would like more information regarding living trusts or would like to set up a consultation with a trusted living trust lawyer in Roseville, CA, please call Yee Law Group Inc..

Client Review

“Mike Yee and his team are amazing. They are fast and efficient, but you don’t feel rushed at all when meeting with them. Mike in particular is extremely patient, knowledgeable and articulate, and made the whole process as pleasant as writing legal documents can be. Highly recommended.”

Gerald Quon