Will Lawyer Roseville, CA

Professional Assistance With Your Will

If you’ve decided that it’s time to write up a will, you may be considering estate planning assistance. Drafting a last will and testament can be a good idea for protecting your family and your property if anything should happen to you. As our experienced Roseville, CA will lawyer can attest, it’s a wise decision to draft a will even if you are in good health. At Yee Law Group Inc., PC, we are here to help. Reach out today to set up a time to discuss your goals and learn how our services can support them.

Table Of Contents

- Professional Assistance With Your Will

- Key Differences Between Wills And Trusts

- Factors That Affect The Validity Of A Will

- Roseville Will Infographic

- Roseville Will Statistics

- Roseville Will FAQs

- Roseville Will Glossary

- Yee Law Group Inc., Roseville Will Lawyer

- Contact Our Roseville Will Lawyer Today

Changes In Circumstance

As life gives and takes away, it is important to update your will to reflect major changes in your personal and familial circumstances. If you gain or lose major assets, your will should be altered in order to ensure that it is current. Similarly, if you marry, divorce, have children, have grandchildren, start a business, close a business, create a valuable intellectual property or otherwise have a major change in the structure of your life, please contact your attorney to make sure your will is up to date.

Unless your wishes are made explicitly known, it will be a court that decides how your property is divided in the event of your death. Similarly, if you do not update your will regularly, your loved ones may challenge the idea that your outdated will does not accurately reflect your wishes at the time of your death. Please update your will as often as you need to in order to maintain its relevance and accuracy. Our will lawyers in Roseville, California, can help you accomplish this with efficiency and precision.

Changes In Expectation

Sometimes an individual’s wishes change, even if circumstances have not. Perhaps you previously designated your oldest child to serve as your power of attorney for medical care but now your youngest child has earned a medical degree and you would feel more comfortable if she served as your power of attorney. Or perhaps you simply realized that you want one of your grandchildren to inherit your mother’s antique tea set instead of leaving it to your cousin. As your wishes and preferences evolve (for whatever reason) please keep your will lawyer Roseville, CA updated about the ways in which your will needs to be altered. Checking in with your will lawyer Roseville, CA on a relatively regular basis will help to ensure that your current wishes are accurately reflected in the terms of your estate plan.

Estate Planning Assistance Is Available

If you have questions about your estate plan generally or updating your will specifically, please consider connecting with a will lawyer Roseville, CA. When it comes to ensuring that your wishes remain known and legally enforceable, it is generally a good idea to ask questions whenever they arise and to update your estate plan whenever it feels appropriate to do so. When it comes to your future and your family’s future, a little preparation now can lead to significant positive consequences later. Also, please keep in mind that consulting with a will lawyer Roseville, CA does not obligate you to take any action whatsoever. Asking questions simply helps to ensure that whatever decisions you ultimately make are informed ones.

Key Differences Between Wills And Trusts

When planning for the future, understanding the differences between wills and trusts is essential for creating an effective estate plan. Both serve distinct purposes and cater to different needs, offering unique benefits depending on your circumstances. Here, we’ll explore the key differences between wills and trusts to help you determine which might be the best option for your situation.

- Timing: Wills take effect after death, whereas trusts can be active during your lifetime.

- Probate: Wills go through probate; trusts do not.

- Control: Trusts provide more flexibility for managing and distributing assets, especially in complex situations.

- Cost: Wills are generally more affordable to create, while trusts involve higher initial costs and ongoing management.

Wills

A will is a legal document that outlines your wishes regarding the distribution of your assets after your death. It can also include instructions for appointing guardians for minor children, naming an executor to manage your estate, and specifying funeral arrangements. A will goes into effect only after your death and must go through probate, a court-supervised process that validates the will and oversees the distribution of assets. The benefits of a will include:

- Simplicity: Creating a will is often straightforward and less expensive than setting up a trust.

- Flexibility: A will can be easily updated as your circumstances change.

- Comprehensive Asset Distribution: You can specify how both real and personal property should be distributed.

However, there are limitations. Since a will must go through probate, the process can be time-consuming, costly, and public. Additionally, wills do not cover certain assets, such as jointly owned property or accounts with designated beneficiaries.

Trusts

A trust is a legal arrangement that allows you to transfer assets to a trustee, who manages them on behalf of your beneficiaries. Trusts can be revocable or irrevocable, and they can take effect during your lifetime or upon your death, depending on the type of trust. Revocable living trusts are the most common type of trust. They allow you to maintain control over your assets while you’re alive and ensure a smooth transition of ownership after your death without going through probate. Irrevocable trusts transfer ownership of assets out of your name permanently, providing benefits like asset protection and potential tax savings. The benefits of trusts include:

- Avoiding Probate: Assets in a trust do not go through probate, saving time and money for your beneficiaries.

- Privacy: Unlike wills, trusts do not become part of the public record.

- Ongoing Management: Trusts are ideal for managing assets for minors or individuals with special needs.

- Tax Advantages: Certain types of trusts can help reduce estate and gift taxes.

Trusts require more time and expense to establish and maintain compared to wills. They also demand careful planning to ensure all intended assets are properly transferred into the trust.

Choosing Your Documents

Your choice will depend on your unique needs, financial situation, and estate planning goals. For many, a combination of both a will and a trust provides the most comprehensive protection and flexibility. A will can handle matters not covered by a trust, such as naming guardians for minor children, while a trust ensures a smoother asset transfer process.

For personalized guidance, consulting an experienced estate planning attorney in Roseville, California, can help you make informed decisions. Our team of attorneys can assess your specific situation and recommend the best strategies to secure your legacy and protect your loved ones.

Factors That Affect The Validity Of Your Will

When it comes to writing a will, it’s important to understand the factors that can affect its validity. A valid will is essential for ensuring your wishes are carried out after you pass, and it can help avoid potential disputes among family members. While creating a will may seem straightforward, there are several legal elements to consider. As we dive into these factors, it’s helpful to remember that working with a Roseville, CA will lawyer can make the process more seamless and efficient.

- Legal Age & Mental Capacity

One of the fundamental requirements for a valid will is that the person making the will, known as the testator, must be of legal age. In most places, the legal age is 18, though there may be some exceptions depending on local laws. In addition to being of legal age, the testator must also have the mental capacity to understand the nature of their decisions and the impact their will may have. This means they need to be fully aware of what they are doing, know the value of their assets, and recognize who will be affected by their choices.

- Free Will & Absence Of Duress

A valid will must be created voluntarily, without any undue influence or pressure from others. If a will is made under duress or coercion, it could be challenged in court and potentially deemed invalid. It’s essential that the testator feels completely free to make decisions about how their assets will be distributed without interference. Family members or other beneficiaries should not have the power to sway the decisions in a way that benefits them unfairly.

- Proper Signing & Witnessing

To be legally binding, a will must be signed by the testator in the presence of witnesses. The number of required witnesses varies depending on state laws, but generally, two or three witnesses are needed. These witnesses must be present when the testator signs the will, and they must also sign the document themselves. Witnesses should not be beneficiaries of the will, as this could create conflicts of interest and raise questions about the document’s validity.

- Compliance With State Laws

Each state has its own set of laws governing wills, including specific requirements regarding how a will should be drafted, signed, and witnessed. Failing to follow these guidelines could render the will invalid. That’s why it’s crucial to be aware of local laws and regulations when preparing a will. Working with a local Roseville will lawyer is one of the best ways to ensure the will complies with all relevant legal requirements and won’t be subject to challenges.

- Lack Of Fraud Or Forgery

A will must be free from fraud or forgery to be considered valid. If someone forges a signature or intentionally alters the will to benefit themselves or another party, the document can be invalidated in court. Fraud can take many forms, including tricking the testator into signing a document they didn’t realize was a will or forging their signature entirely. Courts take fraud and forgery very seriously, and even a small question of dishonesty can lead to the entire will being thrown out.

- Clear Intent

The testator must clearly express their intentions in the will. If the document is ambiguous or unclear, it could lead to confusion or disputes after the testator’s passing. The language used should be straightforward and specific to ensure that beneficiaries and the courts can easily understand the testator’s wishes. Ambiguity can open the door to challenges in probate court, so it’s crucial to be precise in outlining how assets should be distributed.

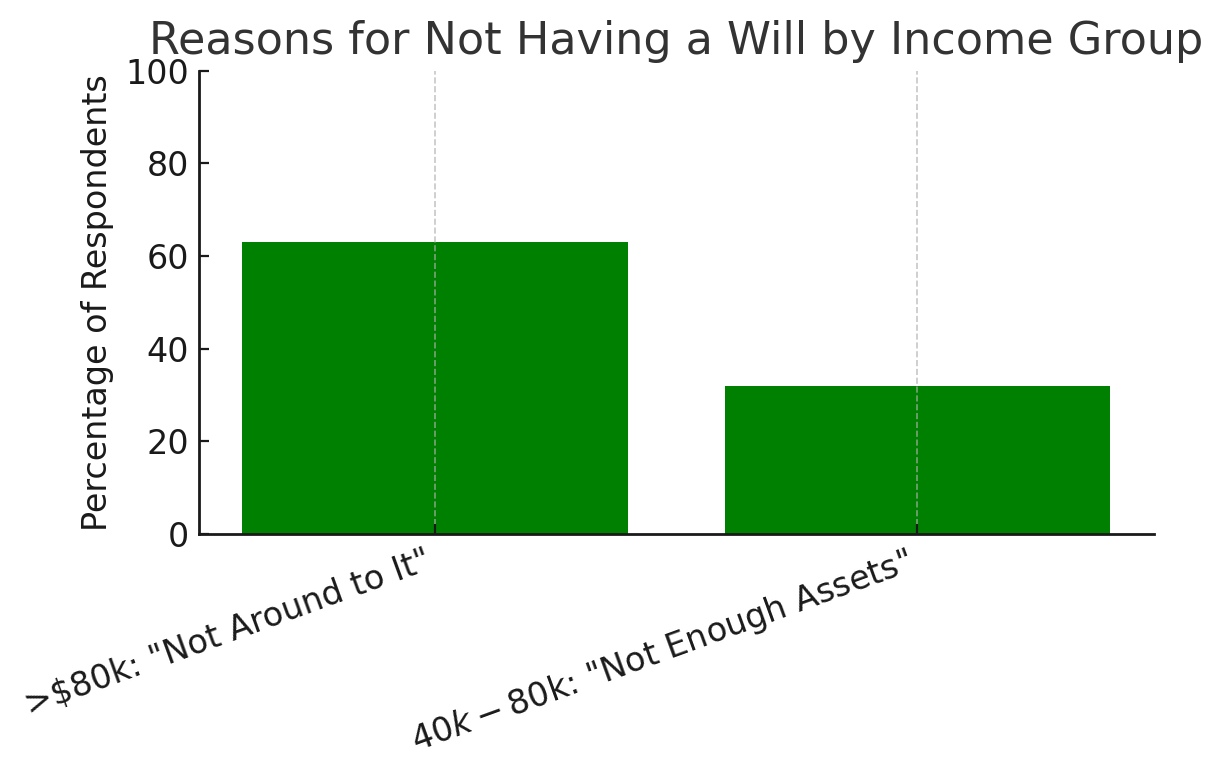

Roseville Will Infographic

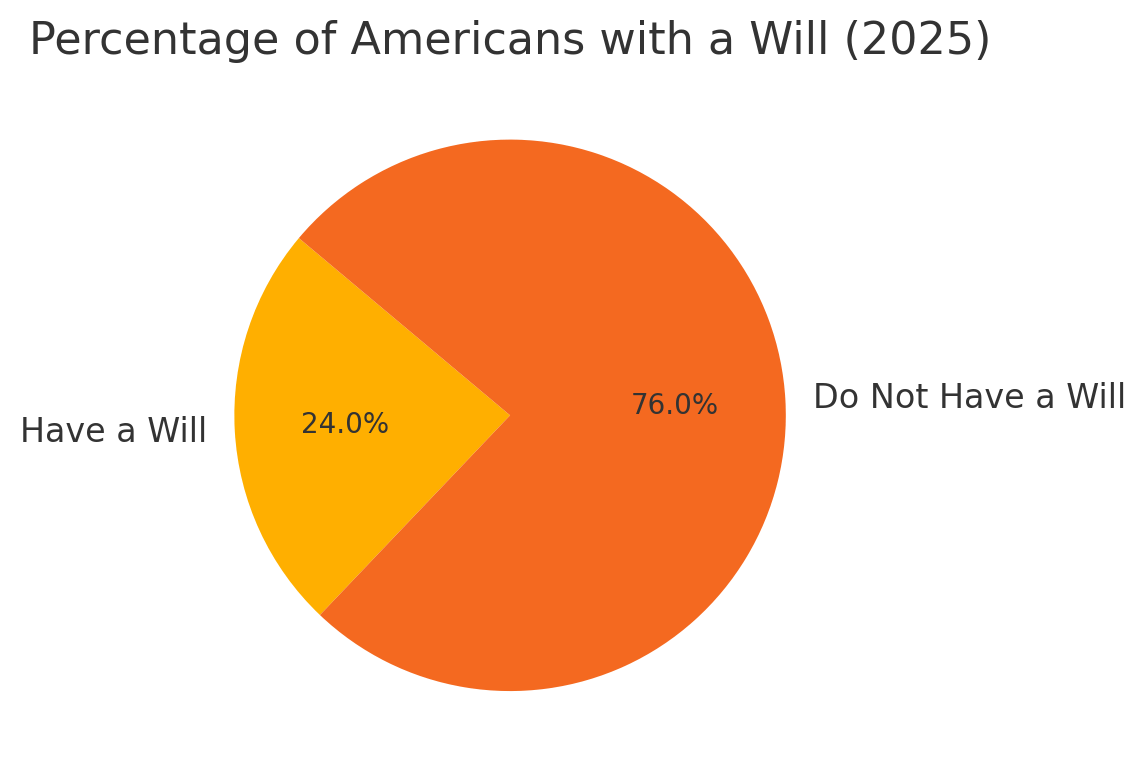

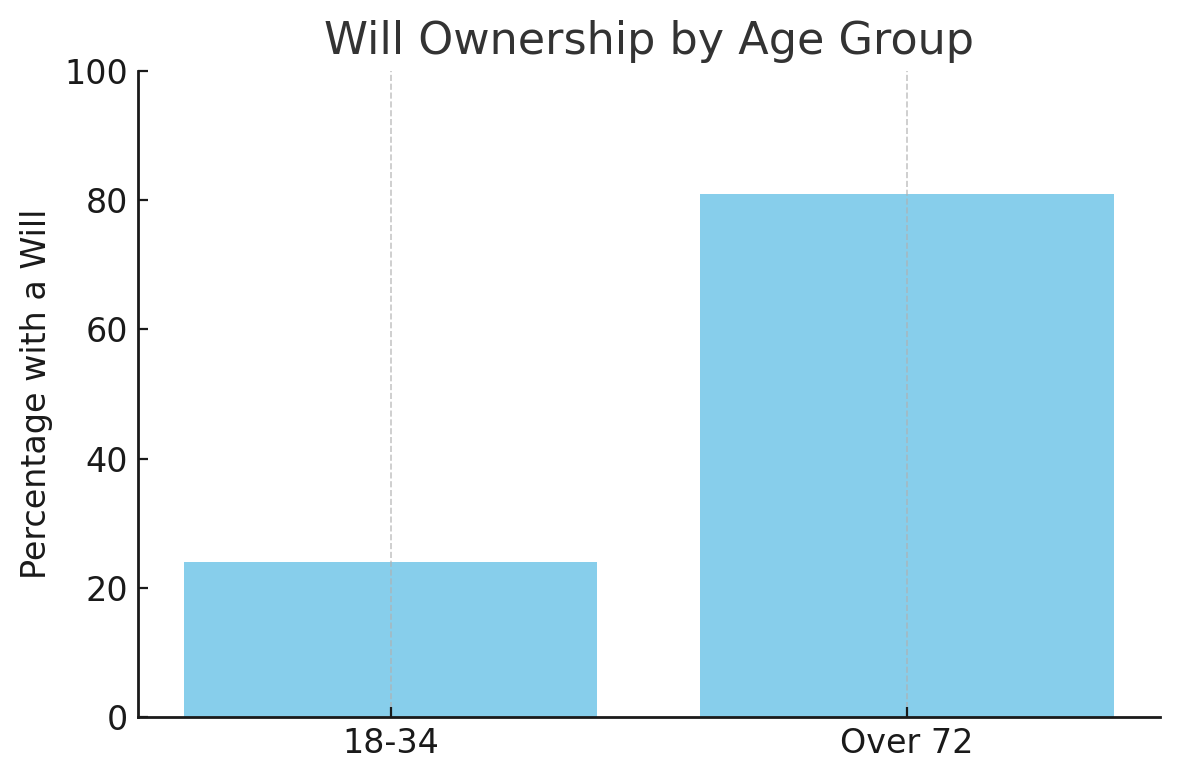

Roseville Will Statistics

Wills are essential components of estate planning, ensuring that an individual’s assets are distributed according to their wishes after death. However, a significant portion of the U.S. population has not established such plans. According to a 2025 survey by Caring.com, only 24% of Americans have created a will or estate planning document.

Age appears to influence will ownership; the same survey found that 81% of individuals over 72 have a will, compared to just 24% of those aged 18 to 34. Additionally, socioeconomic factors play a role; 63% of people earning over $80,000 annually cite not having “gotten around to it” as their primary reason for not creating a will, while 32% of those earning between $40,000 and $80,000 believe they don’t have enough assets to warrant one.

Roseville Will FAQs

What Can Be Accomplished Through A Will?

A will is often used for the transferring of property ownership and the naming of guardians for minors if the original owner/guardian passes. When an individual drafts a will, he/she can specify the following items:

- Naming individuals or organizations that will receive ownership of property

- Naming a personal guardian to care for any minor children

- Naming an individual to manage property that will be transferred to minor children upon reaching a certain age

- Naming an executor, i.e., an individual who is trusted with carrying out the terms of your will

- Instructing how to pay off any remaining debts

- Instructing care for pets

Who Should Write A Will?

Anyone can write up a will to ensure that their property is transferred to the correct people. Regardless of your current health or current financial standing, a will can be very useful because accidents could happen at any time.

You might be particularly interested in creating a will if you receive a large sum of money or you own any valuable property. It can also be a wise decision for parents to create a will upon the birth of any new children. Not only can the parent(s) name individual(s) tasked with caring for their children, but they can also specify how their wealth will be transferred to the children.

What Happens If I Don’t Have A Will?

If an individual passes away without having written a will with the help of your will lawyer in Roseville, there are certain protocols in place intended to pass along the individual’s property and wealth as smoothly as possible.

In California, as in most states, the individual’s property would be distributed to the closest remaining relatives. This often means that an individual’s property is passed along to his/her spouse, children, or sisters and brothers.

When Do I Need To Update My Will?

Generally speaking, estate plans are meant to function as living documents. This essentially means that unlike certain contracts and other legal tools that are not easily revised, estate plans may be altered, added to, revised, and/or updated as often as circumstances require.

If you are ever in doubt as to whether your estate plan could benefit from an update or needs to be updated, please do not hesitate to reach out to our experienced California will attorney. When it comes to wills and other estate planning tools, it is generally a good idea to be as proactive as possible. None of us knows when our estate plans will suddenly become urgent business, so it is not wise to hesitate if you believe your estate plan is in need of attention.

Roseville Will Glossary

When planning for the future, legal clarity matters. At Yee Law Group Inc., we know how important it is to have straightforward information, especially when drafting a will. As your trusted California will lawyer, we’ve compiled key estate planning terms you’ll encounter when working with us. These definitions are designed to help you better understand the tools and language involved in creating or updating your estate plan.

Last Will And Testament

A last will and testament is a legally binding document used to state your instructions about how your assets should be distributed after your death. This document allows you to identify beneficiaries, appoint an executor, name guardians for minor children, and leave specific property to individuals or organizations. A will only takes effect upon your passing and must go through probate before any assets are distributed. In California, failing to create a valid will may result in your property being divided according to state law, regardless of your wishes.

Your will can be updated anytime your personal, financial, or family circumstances change. Keeping it current helps reduce confusion or challenges after your passing. By working with your estate planning lawyer in Roseville, CA, you can make updates quickly and correctly.

Probate Process

The probate process is a court-supervised procedure required to validate a will and oversee the transfer of a deceased person’s assets to the appropriate beneficiaries. This process involves proving the will’s authenticity, appointing the executor, identifying and appraising assets, paying debts and taxes, and finally distributing remaining property.

Probate can be time-consuming and involves court fees and public record filings. While some assets, such as joint property or accounts with designated beneficiaries, bypass probate, most other property listed in a will must go through this process. Choosing a well-drafted will can make probate more efficient and less stressful for your family.

Executor Of The Estate

An executor of the estate is the individual you appoint in your will to handle your estate after your death. Their responsibilities include filing the will with the court, managing probate, paying debts and taxes, securing property, and ensuring all distributions are carried out according to your instructions. The executor must follow legal procedures and act in the best interests of the estate and beneficiaries.

Selecting a reliable executor is one of the most important decisions you’ll make when preparing your will. You can appoint a family member, friend, or even a professional fiduciary. Our Roseville estate lawyer can help guide you through this choice and advise on how to formally designate your executor.

Revocable Living Trust

A revocable living trust is an estate planning tool that allows you to transfer assets into a trust that you manage during your lifetime. Upon your death, a successor trustee takes over to manage or distribute assets without court involvement. Unlike a will, a trust becomes effective while you’re alive and avoids probate altogether.

You maintain control over the trust while you’re living, and you can make changes or revoke it entirely. Many people use both a will and a trust to meet their estate planning needs. A trust may also help with asset management if you become incapacitated. Setting up this tool often requires more planning, but it can provide additional structure and privacy.

Testamentary Capacity

Testamentary capacity refers to the legal and mental ability required to create or modify a valid will. The person drafting the will (the testator) must be of legal age—typically 18 years or older—and must understand the nature and consequences of their decisions. This includes knowing the extent of their assets, recognizing their beneficiaries, and having a clear intent to distribute their property through the will.

If a will is challenged on the basis of lacking testamentary capacity, courts may examine medical history, witness testimony, and other records to assess the testator’s mental state at the time the will was executed. Your attorney can help document the process clearly to prevent disputes over capacity.

For reliable, professional estate planning support, we’re here to help. If you’re considering writing or updating your will, reach out to our team at Yee Law Group Inc. today to schedule a consultation. Let’s work together to create a plan that reflects your goals.

Yee Law Group Inc., Roseville Will Lawyer

919 Reserve Dr, Roseville, CA 95678

Contact Our Roseville Will Lawyer Today

When writing a will, making sure that all legal requirements are met is essential to its validity. A will that follows the necessary steps—such as being signed by the proper witnesses, free from undue influence, and clearly expressing the testator’s intentions—will help avoid legal disputes down the road.

By working with our Roseville will lawyer, you can be confident that your will is legally sound and properly reflects your wishes. Yee Law Group Inc. can guide you through the process and help you create a will that stands up in court. Contact us today, we have over 40 years of combined experience, schedule a consultation and ensure your will is drafted with care and precision.

Client Review

“I highly recommend the Yee Law Group. They are very professional and knowledgeable and I have always had a good experience working with their attorneys and staff. They have earned my trust and confidence for my future needs as well. Great job guys!”

Kenneth Guy